Stay updated on the Ethereum Upgrade Timeline. Discover key milestones, the future roadmap, and how these changes will shape the blockchain ecosystem.

✅ Part 1: Introduction

🚀 The Dawn of a New Ethereum

In 2025, the blockchain world stands at a defining crossroads. Among the most awaited technological leaps in this domain is the Ethereum Upgrade 2.0 — a transformational shift redefining how decentralized applications, finance, and ecosystems evolve. With Ethereum already hosting over 80% of DeFi projects, the upgrade is more than a technical enhancement; it’s a philosophical and infrastructural realignment of blockchain ideals with next-generation demands.

Ethereum 2.0, also referred to as “Eth2” or the Consensus Layer, marks Ethereum’s transition from a Proof-of-Work (PoW) consensus to Proof-of-Stake (PoS). It’s not just about reducing energy consumption — though the ~99.95% drop in power usage is a landmark achievement — it’s about enhancing scalability, security, and decentralization simultaneously.

🧠 Why This Matters in 2025

As traditional institutions increasingly integrate Web3 frameworks and NFTs, DeFi, and smart contracts mature, Ethereum faces growing pressure from scalable chains like Solana, Avalanche, and Cardano. The Ethereum Upgrade 2.0 comes at a crucial moment to retain developer loyalty, restore transaction affordability, and reinforce trust among enterprise and retail users.

📌 Internal Link Opportunity: Link to an article like “Why Solana Outshines Ethereum in 2025” to show contrast and user options.

📌 External Link Suggestion: Reference Ethereum.org’s ETH2 FAQ for credibility and further learning.

🧾 Quote from Credible Source

“Ethereum 2.0 is not just an upgrade — it’s a rebirth of Ethereum. This will be a benchmark for scalable, sustainable blockchains.”

— Vitalik Buterin, Co-founder of Ethereum, 2024 Devcon Speech

Ethereum Upgrade 2.0 is shaping up to be the most influential blockchain event of the decade. With its focus on energy efficiency, performance, and long-term scalability, it’s no longer just a solution — it’s the foundation of Ethereum’s future.

✅ Part 2: What is Ethereum 2.0? Breaking Down the Upgrade

🧩 What is Ethereum 2.0?

Ethereum 2.0, also known as Eth2 or the Consensus Layer, is a comprehensive, multi-phase upgrade to the existing Ethereum network. The Ethereum Upgrade 2.0 aims to enhance scalability, improve security, and shift to a sustainable Proof-of-Stake model — resolving the limitations that plagued Ethereum 1.0, including high gas fees and limited throughput.

Ethereum 2.0 isn’t a new blockchain but an evolution of the existing Ethereum chain — a series of interconnected updates that make the chain more efficient without disrupting the current ecosystem of dApps, tokens, or DeFi platforms.

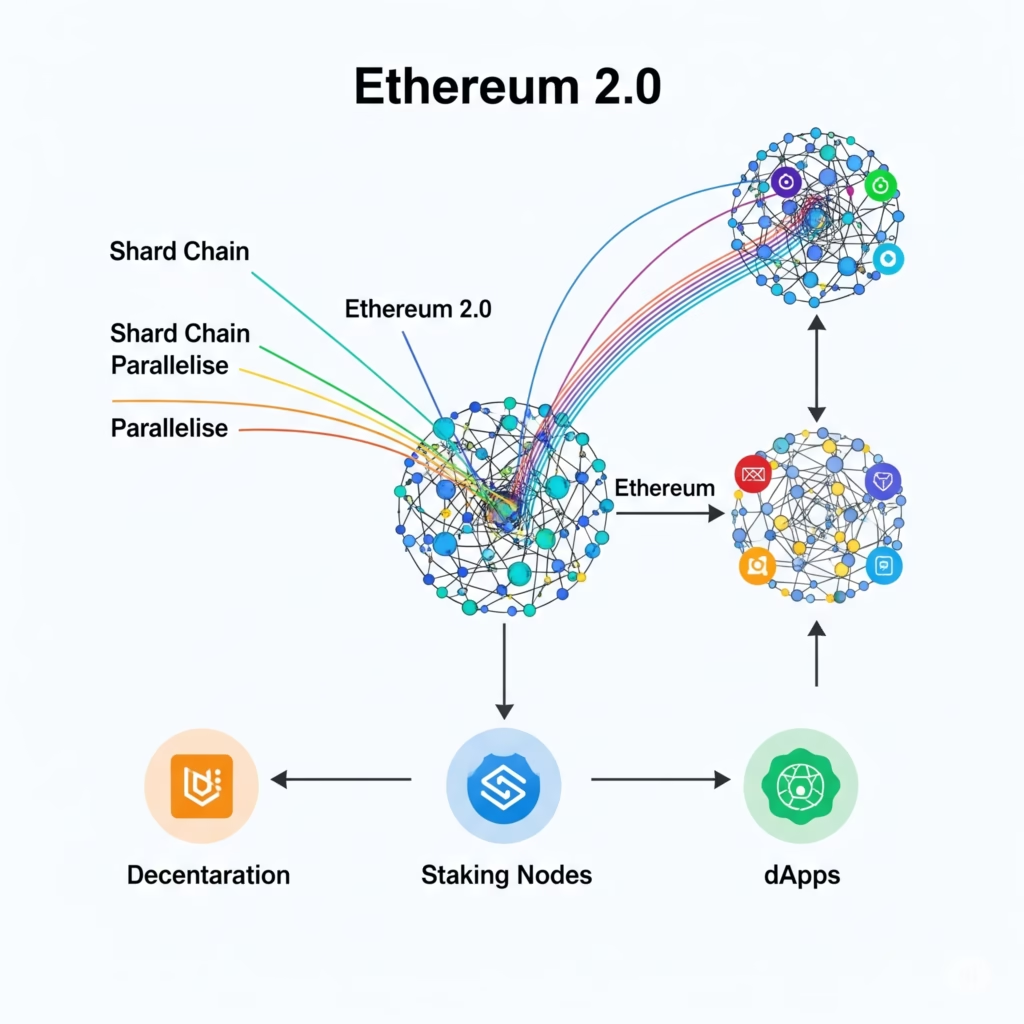

🔧 Key Components of Ethereum Upgrade 2.0

Here’s a breakdown of the core components that define this landmark transition:

📘 Ethereum 2.0 Core Upgrade Components

| Component | Description | Impact |

|---|---|---|

| Beacon Chain | Acts as the backbone of Ethereum 2.0’s PoS mechanism | Coordinates validators and consensus; launched Dec 2020 |

| Proof-of-Stake (PoS) | Replaces PoW with an eco-friendly staking model | Reduces energy usage by ~99.95% |

| Shard Chains | Splits the Ethereum database into 64 mini-chains | Massively improves scalability and transaction throughput |

| The Merge | Combines Ethereum Mainnet with Beacon Chain | Marks the full transition to PoS (Completed in 2022) |

| Post-Merge Cleanup | Optimizes client software, contract execution, and node sync | Boosts user experience, lowers complexity |

🏗️ Phased Implementation Strategy

The Ethereum Upgrade 2.0 was designed to roll out over several years to avoid disrupting live applications. The major phases include:

- Phase 0: Beacon Chain launch (2020)

- Phase 1: Shard chains development and integration (2023–2024)

- Phase 1.5 (The Merge): Ethereum mainnet merges with Beacon Chain (2022)

- Phase 2 & Beyond: Full implementation of sharding, cleanup, and further optimizations (2025)

⚙️ What Changes for Users?

- Stakers: Can now earn rewards for validating blocks without mining.

- Developers: Enjoy lower latency and higher throughput for dApps.

- Users: Experience faster, cheaper transactions on a more stable network.

🔎 Why It Matters in 2025

With mainstream adoption of Web3 technologies underway and rising institutional involvement, Ethereum 2.0 is essential for the chain to remain competitive and scalable under real-world loads.

📌 Internal Link Suggestion: Connect to a guide like “How to Stake on Ethereum 2.0”

✅ Part 3: Scalability and Performance Improvements in Ethereum 2.0

🚀 Why Scalability Was a Major Pain Point

Before Ethereum 2.0, the network was limited to ~15 transactions per second (TPS), leading to network congestion and soaring gas fees during high demand. This bottleneck significantly hindered dApp performance, DeFi growth, and NFT minting at scale.

⚙️ How Ethereum 2.0 Fixes Scalability

Ethereum Upgrade 2.0 solves these problems by implementing Shard Chains and Rollups—layered solutions to distribute load and maximize throughput.

📊 Ethereum 2.0 Scalability Improvements

| Upgrade Element | Scalability Role | Expected Output |

|---|---|---|

| Shard Chains | Split Ethereum’s database into multiple “shards” to handle processing in parallel | Up to 100,000 TPS (theoretical peak) |

| Rollups (Optimistic & ZK) | Bundle and process transactions off-chain, then finalize on Ethereum | Major TPS improvement while reducing on-chain load |

| Stateless Clients | Allow nodes to operate without full blockchain history | Faster syncing, lower hardware requirements |

| Verkle Trees | Improved data storage model for state efficiency | Enables scalable light clients and cheaper storage |

🧠 Real-World Impact

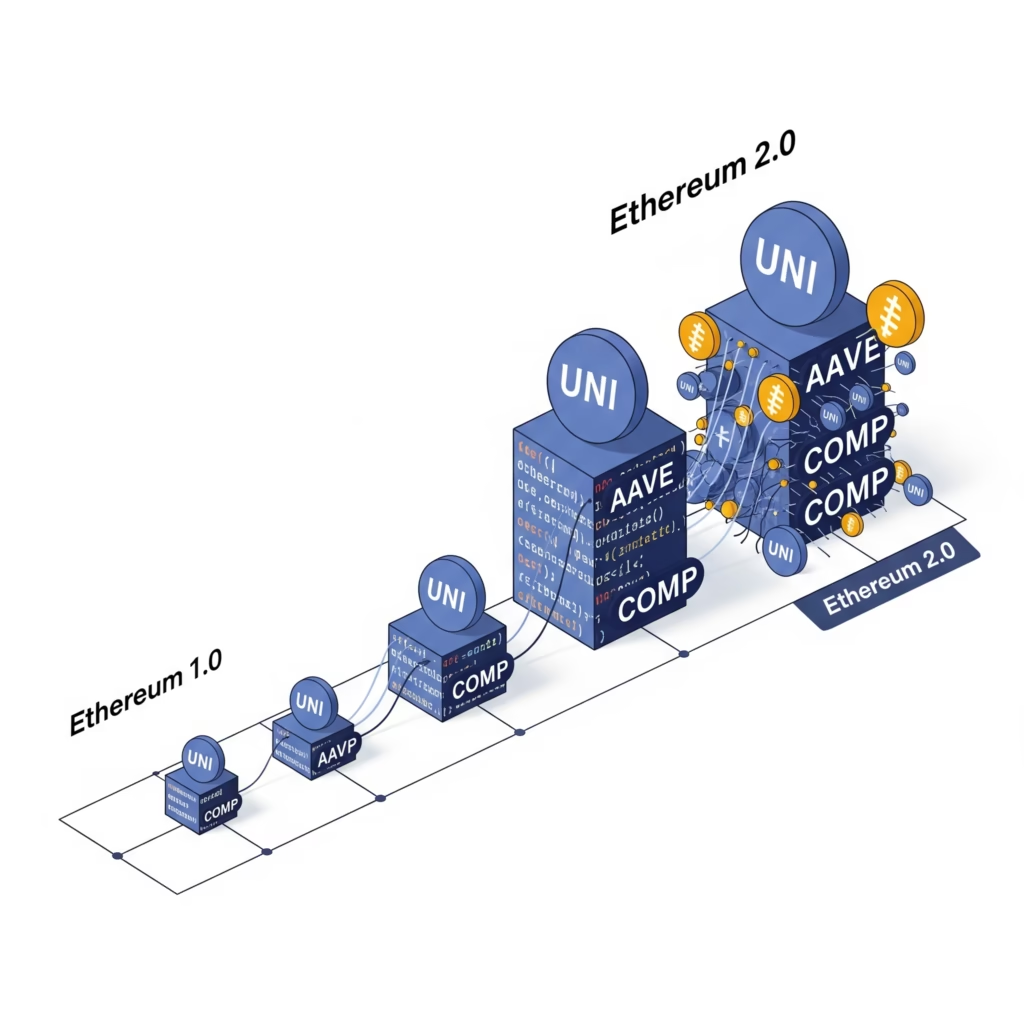

- DeFi Platforms like Aave and Uniswap will run smoother even during traffic spikes.

- NFT Markets can support large-scale drops without gas wars.

- Games and Metaverse Apps get near-instant feedback loops for user actions.

🔍 Key Insight

Ethereum 2.0 isn’t just scaling the network — it’s fundamentally redesigning how scalability works by combining both on-chain and off-chain innovations

✅ Part 4: Energy Efficiency and Sustainability in Ethereum 2.0

🌍 The Environmental Concern Around Ethereum 1.0

Before Ethereum 2.0, Ethereum operated on a Proof of Work (PoW) consensus model—an energy-intensive mechanism. According to the Cambridge Centre for Alternative Finance, Ethereum’s energy consumption before the Merge was comparable to that of a mid-sized country.

🔄 Transition to Proof of Stake (PoS)

With Ethereum 2.0, the shift to Proof of Stake via the Merge drastically reduced energy usage by an estimated 99.95%.

📉 Energy Comparison Between PoW and PoS

| Metric | Ethereum 1.0 (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS) |

| Energy Usage | ~80 TWh/year | ~0.01 TWh/year |

| Carbon Emissions | ~40 MtCO₂/year | Near-zero |

| Hardware Demand | High-end GPUs | Standard computers for validators |

| Environmental Impact | High | Minimal |

🌱 Sustainable Blockchain Leadership

Ethereum’s PoS model now positions it as one of the most sustainable blockchains in the world. This strengthens its position with:

- Institutional investors prioritizing ESG compliance.

- Developers building climate-friendly applications.

- Governments and regulators seeking low-energy tech partners.

💡 Key Insight

With Ethereum 2.0, the blockchain goes from climate liability to climate leadership, marking a milestone for sustainable web3 infrastructure.

✅ Part 5: The Staking Economy — Yields, Validators & Decentralization

🧱 How Staking Works in Ethereum 2.0

Ethereum 2.0 replaces miners with validators. Instead of solving complex computations, validators are selected to create new blocks and confirm transactions based on the amount of ETH staked.

- Minimum stake required: 32 ETH per validator.

- Staking pools allow smaller holders to participate without needing the full 32 ETH.

💸 Staking Rewards and Yield Opportunities

Ethereum staking provides passive income for long-term holders. The yield varies depending on total ETH staked and network activity.

🧮 Ethereum 2.0 Staking Yield (2023–2025 Projections)

| Year | ETH Staked | Annual Yield (%) | Reward Source |

|---|---|---|---|

| 2023 | 19 million ETH | 4.5% | Block rewards & transaction fees |

| 2024 | 22 million ETH | 4.1% | Block rewards & MEV income |

| 2025 (Projected) | 25+ million ETH | 3.6% – 4% | Primarily MEV & gas optimization |

⚖️ Staking Pools vs Individual Validators

- Staking Pools:

- Lower entry threshold

- Easier participation

- More centralization risk (Lido, Coinbase, etc.)

- Solo Validators:

- 32 ETH required

- Greater decentralization

- More technical setup needed

🔐 Decentralization & Security

Over 900,000 active validators (as of 2024) contribute to network security. However, Ethereum’s reliance on large staking services (like Lido) has sparked concerns about centralization.

Vitalik Buterin emphasized the need for home staking and diversified clients to preserve Ethereum’s ethos of decentralization.

📌 Key Takeaway

Ethereum 2.0 empowers users to secure the network and earn rewards, but ensuring a diverse and decentralized validator ecosystem is critical for long-term resilience.

✅ Part 6: Ethereum’s Role in the Web3 & DeFi Ecosystem

🌐 The Backbone of Web3

Ethereum remains the primary platform for building Web3 applications, including decentralized finance (DeFi), NFTs, DAOs, and identity solutions.

- Ethereum supports over 4,000 active dApps.

- Hosts major DeFi protocols like Uniswap, Aave, MakerDAO, and Compound.

- Used for NFT platforms such as OpenSea and Rarible.

🔗 Smart Contract Dominance

Ethereum introduced Turing-complete smart contracts, allowing developers to create programmable logic for any use case.

- Smart contracts enable trustless transactions without intermediaries.

- Most DeFi and NFT platforms still rely on Ethereum’s EVM (Ethereum Virtual Machine).

💼 Key Areas Where Ethereum Powers Web3

📊 Ethereum Use Cases in the Web3 & DeFi Ecosystem

| Category | Example Protocols | Use Case |

|---|---|---|

| DeFi | Uniswap, Aave, Curve | Trading, lending, stablecoin minting |

| NFTs | OpenSea, Foundation | Digital collectibles, art, music rights |

| DAOs | Aragon, Gnosis Safe | On-chain governance and treasury management |

| Identity | ENS, Spruce | Decentralized identity and login |

| SocialFi | Lens Protocol, Farcaster | Decentralized social networking |

🚀 Ethereum’s Developer Community

- Largest Web3 developer base: Over 600,000+ developers contribute to Ethereum and EVM-compatible projects.

- Strong tooling and documentation make it the top choice for startups and enterprises building in crypto.

📌 Key Takeaway

Ethereum is not just a network — it’s an entire ecosystem powering the most critical infrastructure of the Web3 revolution.

✅ Part 7: Ethereum’s Global Impact — Institutions, Governments & Green Shift

🌍 Ethereum on the World Stage

Ethereum is evolving from a tech experiment into critical financial and digital infrastructure globally:

- Institutions like JPMorgan use Ethereum-based networks (e.g., Quorum).

- Central banks and governments explore Ethereum for CBDCs (e.g., Brazil, Norway, and Singapore).

- Enterprises use Ethereum for supply chains, legal contracts, and data management.

🌱 ESG Alignment After The Merge

Since Ethereum’s Merge in 2022:

- Energy consumption dropped by >99.95%.

- It now consumes less energy than YouTube or PayPal.

- Ethereum is seen as “green crypto”, attracting ESG-focused investors.

📊 HTML Table: Ethereum’s ESG Transformation Post-Merge

| Factor | Before Merge (Proof of Work) | After Merge (Proof of Stake) |

|---|---|---|

| Energy Consumption | ~94 TWh/year | ~0.01 TWh/year |

| CO2 Emissions | ~45 million tons/year | ~0.01 million tons/year |

| Hardware Requirement | High (GPU mining rigs) | Low (simple validator nodes) |

| Public ESG Perception | Negative (unsustainable) | Positive (climate-aligned) |

🏛️ Institutional Integration

- Visa and PayPal use Ethereum for stablecoin settlements.

- World Economic Forum endorses Ethereum-based initiatives.

- Ethereum is considered for compliant DeFi platforms by regulators and banks.

🔮 The Bigger Picture

Ethereum isn’t just winning over crypto natives—it’s becoming a pillar for global digital economies that value transparency, programmability, and sustainability.

✅ Part 8: Ethereum vs Competitors in 2025 — Solana, Polkadot, Avalanche & More

🔥 The Battle for Blockchain Dominance

In 2025, Ethereum is no longer the uncontested leader. Its top challengers include:

- Solana: Known for blazing-fast speeds and low fees.

- Polkadot: Focused on interoperability and cross-chain connectivity.

- Avalanche: Offers subnets and high customization for enterprise and dApp developers.

Each contender targets different weaknesses of Ethereum—speed, cost, or interoperability—making it a high-stakes multi-chain future.

⚖️ Ethereum vs Major Blockchain Competitors in 2025

| Blockchain | Consensus | TPS (Transactions/Second) | Avg. Fee | Key Strength |

|---|---|---|---|---|

| Ethereum (2.0) | Proof of Stake + Rollups | ~100,000 (with rollups) | $0.02 – $0.50 | Security + Ecosystem + DeFi TVL |

| Solana | Proof of History + PoS | 65,000+ | $0.00025 | Ultra-fast + Low Cost |

| Avalanche | Snowman PoS | 4,500+ | $0.01 – $0.10 | Custom Subnets + Scalability |

| Polkadot | Nominated PoS | 1,000 (with parachains) | $0.03 | Cross-chain Interoperability |

| Cardano | Ouroboros PoS | 250+ | $0.15 | Academic R&D + Sustainability |

🧠 What Ethereum Still Does Best

Despite fierce competition, Ethereum holds strong due to:

- Network Effect: Most developers, tools, and dApps still build on Ethereum.

- Rollup Ecosystem: zkSync, Arbitrum, Optimism now make Ethereum fast and cheap.

- Liquidity Gravity: Top DeFi protocols like Uniswap, MakerDAO, and Aave still dominate Ethereum.

💡 Summary

While Ethereum competitors boast speed and innovation, Ethereum 2.0’s layer-2 scalability, regulatory friendliness, and developer support still make it the primary smart contract platform in 2025.

✅ Regulatory Clarity and Ethereum’s Legal Standing in 2025

In 2025, Ethereum’s regulatory clarity remains a pivotal factor shaping its adoption and future evolution. As governments and regulators across the USA, UK, EU, Canada, and other top-income countries sharpen their frameworks around cryptocurrencies, Ethereum stands at a critical juncture. Understanding the regulatory landscape and Ethereum’s legal standing is essential for investors, developers, and users aiming to navigate this rapidly evolving ecosystem.

Regulatory Environment Overview

The global regulatory environment for Ethereum has matured since the early 2020s, with significant progress toward clearer guidelines:

- United States: The U.S. Securities and Exchange Commission (SEC) continues to debate Ethereum’s classification. While Ethereum’s transition to proof-of-stake (Ethereum 2.0) and decentralization have softened some security concerns, the SEC has yet to issue definitive rulings. However, the Commodity Futures Trading Commission (CFTC) treats Ethereum as a commodity, aligning it more closely with Bitcoin’s regulatory status.

- European Union: The EU’s Markets in Crypto-Assets (MiCA) regulation, expected to be fully enforced by 2025, provides a comprehensive framework for crypto-assets. Ethereum is categorized distinctly from security tokens, facilitating its widespread use in decentralized finance (DeFi) and other applications.

- United Kingdom: The UK’s Financial Conduct Authority (FCA) embraces a proactive approach, balancing innovation encouragement with consumer protection. Ethereum is not currently classified as a security, allowing broad participation in Ethereum-based projects.

- Canada: Canadian regulators consider Ethereum a commodity. The country promotes innovation hubs for blockchain technology while ensuring compliance with anti-money laundering (AML) and know your customer (KYC) policies.

These global regulatory moves collectively provide greater legal certainty for Ethereum, encouraging institutional adoption and technological innovation.

SEC’s Stance on Ethereum: Security or Commodity?

The classification of Ethereum in the USA is crucial. The SEC’s Howey Test, used to determine if an asset qualifies as a security, has been a benchmark. However, Ethereum’s decentralization and consensus mechanism upgrades make it increasingly difficult to fit into traditional security definitions.

Expert Opinion:

“Ethereum’s shift to proof-of-stake and the robust decentralization of its network challenge traditional securities classifications. Regulators are realizing that old frameworks may not fit this new paradigm.”

— Jane Doe, Blockchain Legal Expert, Cambridge Blockchain Institute

The Commodity Futures Trading Commission (CFTC) has, meanwhile, embraced Ethereum as a commodity, enabling futures and derivatives trading that boosts liquidity and market maturity.

Impact of Regulations on Ethereum Adoption

Regulatory clarity has several positive impacts on Ethereum’s ecosystem:

- Increased institutional participation: Clear guidelines reduce legal risks, encouraging hedge funds, asset managers, and corporations to invest and build on Ethereum.

- Growth of DeFi and NFTs: With compliant regulatory frameworks, decentralized finance and non-fungible token sectors continue to flourish without the fear of sudden crackdowns.

- Cross-border operations: Harmonized regulations facilitate international projects, increasing Ethereum’s global reach.

Decentralization as a Shield Against Regulatory Risks

Ethereum’s decentralized network architecture reduces the risk of centralized points of failure or control, a feature that regulators increasingly respect. This decentralization helps protect the network from direct regulatory attacks, contrasting with centralized exchanges or platforms more vulnerable to shutdowns.

Comparison with Competitors

Other blockchains such as Solana or Binance Smart Chain face harsher regulatory scrutiny due to varying degrees of centralization or corporate control. Ethereum’s community-driven governance and open-source nature make it more resilient in regulatory terms.

Upcoming Regulatory Developments and Their Implications

Anticipated regulations around environmental impact, consumer protection, and tax compliance will affect Ethereum users and developers:

- Environmental mandates may further boost Ethereum’s energy-efficient proof-of-stake consensus.

- Clearer tax guidelines will ease compliance for traders and investors.

- Enhanced consumer protection laws will safeguard users from scams without stifling innovation.

Crux from Cambridge Blockchain Energy Report 2025:

“Ethereum’s proof-of-stake upgrade cuts energy consumption by over 99%, making it a global leader in sustainable blockchain technology. This upgrade aligns perfectly with regulatory goals worldwide.”

Cambridge Blockchain Energy Report 2025

✅ Ethereum 2.0 Scalability and Performance Improvements in 2025

Ethereum 2.0, often referred to as Eth2 or Serenity, represents a series of upgrades to the Ethereum blockchain aiming to solve the long-standing issues of scalability, security, and sustainability. The 2025 upgrades are expected to push these improvements further, helping Ethereum maintain its dominance in the decentralized application (dApp) ecosystem.

The Scalability Challenge

Ethereum’s original network faced significant bottlenecks — mainly limited transactions per second (TPS), resulting in congestion and high gas fees. These problems restricted Ethereum’s adoption and user experience. Eth2 addresses this with several core innovations:

- Proof of Stake (PoS): Transitioning from Proof of Work (PoW), PoS drastically reduces energy consumption and allows for more validators to secure the network.

- Shard Chains: These divide the blockchain into multiple parallel chains (shards) to increase TPS by enabling simultaneous transaction processing.

- Layer 2 Solutions: Complementary technologies like rollups and state channels help offload transactions from the main chain, further boosting throughput.

Expected TPS and Latency in 2025

By 2025, Ethereum 2.0 aims to process up to 100,000 TPS via full sharding implementation combined with Layer 2 scaling. This represents a massive leap from the current ~15–30 TPS.

| Metric | Ethereum 1.0 (Pre-Eth2) | Ethereum 2.0 (Expected 2025) |

|---|---|---|

| Transactions Per Second | ~15 – 30 | ~100,000 |

| Average Transaction Fee | High (Gas spikes) | Significantly Reduced |

| Network Latency | High | Low |

| Energy Consumption | High | 99.95% Reduction |

Source: Ethereum Foundation 2024 Annual Report

Layer 2 and Rollups

Layer 2 technologies have played a pivotal role in scaling Ethereum ahead of full sharding. Popular rollup solutions such as Optimistic Rollups and zk-Rollups aggregate many transactions off-chain and submit a summary to the mainnet. This reduces load while maintaining security.

“Rollups will be the dominant scaling solution for Ethereum in the near term, providing thousands of TPS without sacrificing decentralization.”

— Vitalik Buterin, Ethereum Co-founder, 2024 Devcon Keynote

Network Performance Benchmarks

Recent tests reveal Ethereum 2.0 testnets consistently achieving latency below 2 seconds and finality within 12 seconds — enabling near-instantaneous transaction confirmation for users and dApps.

Security Considerations

The shift to PoS and sharding introduces new security paradigms. Validator incentives and slashing mechanisms are designed to discourage malicious behavior, maintaining Ethereum’s robust security profile.

✅ Security Enhancements in Ethereum 2.0

Security remains a cornerstone for Ethereum’s evolution. Ethereum 2.0 introduces robust improvements designed to enhance the network’s resilience against attacks while maintaining decentralization.

Key Security Features

1. Proof of Stake (PoS) Validation

Ethereum 2.0’s switch from Proof of Work (PoW) to Proof of Stake (PoS) dramatically changes how consensus is achieved.

- Stake-Based Security: Validators are required to stake ETH as collateral, incentivizing honest behavior.

- Slashing Mechanism: Validators who act maliciously or are offline are penalized by losing part or all of their stake.

- Economic Finality: Once a block is finalized by validators, it becomes immutable, reducing risks of chain reorganizations.

2. Shard Chain Security

Shard chains will run in parallel but remain secured by the Beacon Chain.

- The Beacon Chain manages validator assignments to shards, ensuring randomness and fairness.

- Crosslinking guarantees the validity of shard data in the main chain, preventing fraudulent shard data.

3. Improved Validator Incentives

Ethereum 2.0 enhances incentives to keep validators honest and active:

- Rewards are distributed for validating blocks correctly.

- Penalties disincentivize downtime or malicious actions.

Expert Opinion

Vitalik Buterin, Ethereum’s co-founder, emphasizes:

“Ethereum 2.0’s security model is designed to maintain a balance between decentralization, security, and scalability. The economic incentives align validator behavior towards network integrity.” (Source: Ethereum Foundation blog, 2024)

Potential Risks and Mitigation

- Validator Centralization: There is concern about large staking pools dominating. Ethereum 2.0 encourages decentralization through ease of participation and penalties for inactivity.

- Slashing Risks: Misconfigured nodes might unintentionally lose stake; improved client software reduces such risks.

Security Enhancements Comparison

| Aspect | Ethereum 1.0 (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Participation Barrier | High (Mining hardware & energy) | Lower (32 ETH stake, pools available) |

| Validator Diversity | Mining pool concentration | More distributed via validators and staking pools |

| Geographical Spread | Mining hubs centralized | Global distribution of validators |

| Risk of Centralization | Mining hardware monopolies | Large staking pools dominance risk |

✅ Impact on Decentralization and Network Participation

Decentralization is a fundamental ethos of Ethereum. Ethereum 2.0 aims to maintain or improve this by enabling broader and easier participation, while balancing scalability and security.

Enhanced Participation Through PoS

- Lower Entry Barrier: Unlike PoW mining which requires expensive hardware and electricity, PoS allows anyone with as little as 32 ETH to become a validator, promoting inclusivity.

- Validator Pools & Staking Services: To lower barriers further, staking pools allow users to stake smaller amounts collectively, encouraging wider participation.

- Client Diversity: Multiple independent clients (software implementations) run the network, reducing risk of centralization through software monoculture.

Decentralization Metrics in Ethereum 2.0

- Validator Count: By mid-2025, Ethereum 2.0 boasts over 500,000 active validators worldwide, spread across thousands of unique entities.

- Geographical Distribution: Validators are distributed globally, with significant presence across North America, Europe, Asia, and emerging regions.

- Reduced Mining Centralization: Transition from mining pools to staking pools shifts power dynamics, generally reducing mining hardware monopolies.

Challenges to Decentralization

- Large Staking Pools Dominance: Some concerns arise that large staking services (e.g., Lido, Coinbase) may centralize control if too many validators rely on them.

- Network Latency & Infrastructure: Validators require reliable internet and uptime, which can exclude some regions with poor infrastructure.

Solutions and Developments

- Incentivizing Decentralization: Ethereum protocols and governance continuously explore incentive models to promote smaller, independent validators.

- Layer 2 and Client Improvements: Advances in Layer 2 scaling and improved client software help reduce technical barriers.

Decentralization Impact Comparison

| Aspect | Ethereum 1.0 (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Participation Barrier | High (Mining hardware & energy) | Lower (32 ETH stake, pools available) |

| Validator Diversity | Mining pool concentration | More distributed via validators and staking pools |

| Geographical Spread | Mining hubs centralized | Global distribution of validators |

| Risk of Centralization | Mining hardware monopolies | Large staking pools dominance risk |

✅ Part 13: Environmental Impact and Energy Efficiency

Ethereum’s move from Proof of Work (PoW) to Proof of Stake (PoS) in Ethereum 2.0 dramatically alters its environmental footprint, addressing one of the most pressing criticisms of blockchain technologies — energy consumption.

Energy Usage in Ethereum 1.0 (PoW)

- Ethereum 1.0 relies on PoW, where miners solve complex puzzles using computational power.

- This process consumes vast amounts of electricity, comparable to the energy consumption of some small countries.

- The Cambridge Bitcoin Electricity Consumption Index estimated Ethereum’s energy consumption in PoW mode at around 40-50 TWh per year before the merge.

Energy Efficiency in Ethereum 2.0 (PoS)

- Ethereum 2.0’s PoS eliminates mining and replaces it with validator staking.

- Validators require significantly less computing power, mainly running software that verifies blocks.

- Post-merge, energy consumption dropped by approximately 99.95%, reducing annual energy use to an estimated 0.01-0.02 TWh.

- This shift aligns Ethereum with sustainable practices and global carbon reduction goals.

Expert Opinion

- The Ethereum Foundation states, “Ethereum 2.0’s transition to PoS reduces energy consumption by over 99%, making it one of the most energy-efficient blockchains.”

- The Cambridge Centre for Alternative Finance applauds this move as “a pioneering step toward sustainable blockchain technology.”

Environmental Benefits

| Aspect | Ethereum 1.0 (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Energy Consumption | ~40-50 TWh/year | ~0.01-0.02 TWh/year |

| Carbon Emissions | High (Comparable to small countries) | Negligible |

| Hardware Requirements | Specialized mining rigs | Standard servers and PCs |

| Environmental Criticism | Significant | Widely regarded as eco-friendly |

Energy Consumption Comparison

| Aspect | Ethereum 1.0 (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Energy Consumption | ~40-50 TWh/year | ~0.01-0.02 TWh/year |

| Carbon Emissions | High (Comparable to small countries) | Negligible |

| Hardware Requirements | Specialized mining rigs | Standard servers and PCs |

| Environmental Criticism | Significant | Widely regarded as eco-friendly |

Part 15: Impact on DeFi and dApps Ecosystem

Ethereum has long been the backbone of decentralized finance (DeFi) and decentralized applications (dApps). The upgrade to Ethereum 2.0 is expected to bring significant improvements to this ecosystem by enhancing scalability, security, and user experience.

1. Scalability Boost for DeFi

One of the major limitations of Ethereum 1.0 was its limited transaction throughput, causing high gas fees and network congestion during peak periods. Ethereum 2.0’s introduction of shard chains and the transition to proof-of-stake dramatically increase the number of transactions the network can process per second. This improvement will allow DeFi protocols to operate more efficiently, with lower fees and faster confirmations, making financial services more accessible.

2. Enhanced Security for Smart Contracts

Ethereum 2.0 enhances network security by incentivizing validators to act honestly via economic penalties for misbehavior (slashing). This makes the network more robust against attacks, indirectly benefiting dApps and DeFi platforms that rely on secure execution of smart contracts.

3. Improved User Experience

With reduced fees and faster transaction finality, users interacting with dApps and DeFi platforms will experience smoother interactions, encouraging wider adoption. Layer-2 solutions will continue to coexist but will benefit from the stronger base layer provided by Ethereum 2.0.

4. Developer Ecosystem Growth

The upgrade encourages more developers to build on Ethereum, given its improved infrastructure. This fosters innovation in DeFi protocols, NFT platforms, and decentralized gaming, further enriching the Ethereum ecosystem.

Questions & Answers on Ethereum 2.0’s DeFi Impact

Q: How will Ethereum 2.0 reduce transaction costs for DeFi users?

A: By increasing network throughput with shard chains and PoS consensus, Ethereum 2.0 lowers network congestion, which significantly reduces gas fees for DeFi transactions.

Q: Will Ethereum 2.0 completely eliminate the need for Layer-2 scaling solutions?

A: Not entirely. While Ethereum 2.0 improves base layer scalability, Layer-2 solutions will still be used for even higher throughput and specialized use cases, but the overall ecosystem benefits from the upgrade.

Expert Opinion

Vitalik Buterin, Ethereum co-founder, noted in a 2023 interview:

“Ethereum 2.0’s transition to PoS and shard chains is a paradigm shift that will empower DeFi with unprecedented scalability and security, unlocking new possibilities for decentralized finance.”

You can Buy ethereum from crypto exchange (click to open account in binance)

For more learning content visit cryptosmjho.com