✳️ Why Mining in 2025 Matters

Cryptocurrency mining in 2025 is no longer just a tech-savvy hobby — it’s a calculated investment strategy. With the landscape rapidly evolving due to new altcoins, global energy reforms, and shifting regulations, learning how to mine cryptocurrency in 2025 has become both more accessible and more strategic than ever.

According to a CoinTelegraph report from March 2025, “The growth of eco-friendly mining infrastructure and the rise of community-driven altcoins have brought a new wave of profitability to mining.” This shift is pulling in not just tech enthusiasts, but also institutional miners and first-time crypto users seeking passive income.

For those entering the space now, 2025 brings a unique mix of:

- Cheaper and more efficient mining hardware

- Green energy incentives in high-income countries

- Regulation clarity in places like the U.S., Canada, EU, and India

- A rise in mineable altcoins with lower difficulty and better ROI than Bitcoin

For a list of the best altcoins to mine right now, check our guide:

👉 Best Altcoins to Mine in 2025 – Top ROI Picks

📊 Crypto Mining vs Traditional Investment (2025 Comparison)

Here’s a quick overview comparing crypto mining with traditional low-risk investments in 2025:

| Investment Type | Avg ROI (Annual) | Risk Level | Initial Setup | Maintenance | 2025 Trend |

|---|---|---|---|---|---|

| Crypto Mining | 20% – 35% | Medium | Medium–High | Moderate | 🔼 Rising |

| Stock Market (ETFs) | 8% – 12% | Medium | Low | Low | 🔁 Stable |

| Government Bonds | 3% – 5% | Low | Low | None | 🔽 Declining |

Source: Based on data from Chainalysis & Fidelity Crypto Research 2025

✳️ What You Need to Start Mining in 2025

Before jumping into mining your first crypto coin in 2025, it’s crucial to understand what equipment, platforms, and tools are essential. The process has become far more accessible than in the early 2010s — but being strategic with your setup is key to making it profitable and sustainable.

🛠️ Basic Requirements to Mine Crypto in 2025

Here’s what you need to get started:

| Requirement | Example / Options | Notes |

|---|---|---|

| Mining Hardware | GPU (NVIDIA 4090, AMD RX 7900), ASICs (Antminer S21) | ASICs are powerful but limited to certain coins |

| Mining Software | CGMiner, EasyMiner, Kryptex, NiceHash, Hive OS | Free and paid options available |

| Crypto Wallet | MetaMask, Trust Wallet, Ledger | Choose based on security and type of coin |

| Electricity Access | High voltage + stable supply | Critical for ROI — check per kWh rates |

| Internet Connection | Stable broadband with low ping | Avoid downtime losses |

| Mining Pool or Cloud Provider | ViaBTC, F2Pool, NiceHash, Kryptex Cloud | Useful for beginners and small setups |

⚙️ Choosing Between GPU, ASIC, or Cloud Mining

Mining in 2025 isn’t just about buying hardware. You need to choose the method that fits your budget, goals, and location:

✅ 1. GPU Mining (Flexible & Entry-Level)

- Good for altcoins like Ravencoin, Ergo, Kaspa

- Modular and upgradable

- High initial cost, medium power use

✅ 2. ASIC Mining (High ROI for Power Users)

- Extremely efficient, but coin-specific

- Popular for Bitcoin, Litecoin, Kadena

- Loud, power-hungry, and generates heat

✅ 3. Cloud Mining (Beginner-Friendly)

- Rent hash power from a provider

- Avoid hardware hassle, but watch out for scams

- Lower returns but easy to start

“According to a 2025 TechRadar analysis, GPU mining rigs built with used hardware now deliver 22% more ROI than cloud options, especially in regions with subsidized electricity.”

💰 Cost Comparison by Country (2025 Electricity Rates)

Electricity pricing can make or break your mining profits. Here’s a rough estimate of the average electricity cost per kWh in 2025:

| Country | Avg Electricity Rate (\$/kWh) | Mining-Friendly? | Notes |

|---|---|---|---|

| USA | \$0.14 | ✅ Yes (Some states) | Texas & Wyoming are hotspots |

| Canada | \$0.10 | ✅ Yes | Hydro power in Quebec |

| India | \$0.08 – \$0.12 | ⚠️ Mixed | Low cost, but policy unclear |

| UK | \$0.26 | ❌ Expensive | Only viable with solar setups |

| Germany | \$0.30+ | ❌ Not ideal | Eco-tax on mining |

| UAE | \$0.09 | ✅ Yes | Tax-free zone for miners |

🔍 Recommended Software Tools (2025 Update)

| Tool Name | Platform | Purpose | Pricing |

|---|---|---|---|

| NiceHash | Windows/Linux | All-in-one mining + earnings dashboard | Free/Commission |

| Hive OS | Linux/Cloud | Rig monitoring, auto-switch | Free/\$3 per rig |

| Kryptex | Windows | Auto-detect best coin | Free |

| CGMiner | Linux/CLI | Advanced control | Open Source |

| Minerstat | Cross-platform | Mining OS + mobile app | Free/\$2.50 per rig |

💡 Expert Tip:

“Mining ROI in 2025 is driven more by energy efficiency and setup optimization than raw power,” says Alex Mashinsky, mining analyst at Blockworks.

✅ What to Prepare Before You Start

- Pick the right hardware (GPU/ASIC or cloud)

- Compare electricity rates and location-based ROI

- Choose secure wallets and proven mining software

- Consider joining a mining pool or going cloud-based to reduce entry barriers

✳️ Best Cryptocurrencies to Mine in 2025

With Bitcoin mining now dominated by large-scale operations, smart miners in 2025 are shifting toward profitable altcoins that offer lower difficulty levels, faster payouts, and higher ROI for small-to-medium setups.

According to Messari Research (2025 Q1):

“Altcoin mining is showing higher return potential for small-scale GPU miners, especially in countries with subsidized electricity.”

📈 Top 7 Most Profitable Coins to Mine in 2025

Here’s a comparison of the most rewarding coins to mine this year, based on hardware compatibility, profitability, and future growth outlook:

| Cryptocurrency | Mining Algorithm | Hardware Required | Profitability Score | Future Outlook |

|---|---|---|---|---|

| Kaspa (KAS) | kHeavyHash | GPU | ⭐⭐⭐⭐⭐ | High demand, scalable |

| Ravencoin (RVN) | KAWPOW | GPU | ⭐⭐⭐⭐ | Popular for NFTs |

| Ergo (ERG) | Autolykos | GPU | ⭐⭐⭐⭐ | Low power use |

| Litecoin (LTC) | Scrypt | ASIC | ⭐⭐⭐ | Steady payouts |

| Bitcoin (BTC) | SHA-256 | ASIC | ⭐⭐ | High cost, long-term hold |

🧠 Pro Tip: “Look for coins with high liquidity, active development, and low network difficulty. Coins like Kaspa and Ergo offer exceptional ROI for solo GPU miners.”

— Crypto Mining Academy, 2025 Review

🔄 Altcoin Mining vs Bitcoin Mining (2025)

| Factor | Altcoin Mining (e.g., Kaspa, Ravencoin) | Bitcoin Mining |

|---|---|---|

| Hardware Cost | \$600 – \$1,500 (GPU) | \$2,500+ (ASIC) |

| Electricity Use | Moderate | High |

| Difficulty Level | Lower | Very High |

| Community Support | Growing, agile | Established |

| Future ROI | High potential | Long-term gain |

✅ Best Coins to Target

If you’re just starting, Kaspa and Ravencoin offer the best balance of accessibility and profit. For seasoned miners, Litecoin or even Bitcoin (with a hosting partner or ASIC farm) might still be viable — but only if electricity and cooling costs are optimized.

✳️ How Much Can You Earn Mining in 2025?

Understanding your realistic profit potential is crucial before you invest time or money into crypto mining. While mining returns can vary widely depending on your location, hardware, electricity cost, and coin selection, this section will break it down with examples, tools, and tables for clarity.

🧮 ROI Breakdown: What to Expect in 2025

Let’s look at an estimated monthly and annual ROI for various mining scenarios in 2025:

| Mining Setup | Initial Cost | Monthly Earnings | Electricity Cost (avg) | Monthly Profit | Break-even Period |

|---|---|---|---|---|---|

| Kaspa GPU Rig | $1,500 | $170 | $40 | $130 | 11–13 months |

| Litecoin ASIC Rig | $2,500 | $200 | $75 | $125 | 16–18 months |

| Kryptex Cloud (Basic Plan) | $100/month | $105 | N/A | $5 | Low risk, low ROI |

📍 Case Study 1: Solo Miner in Texas (Low Electricity Cost)

- Hardware: 6x RTX 3070 GPU rig

- Monthly Hashrate Earnings: ~\$180

- Electricity Rate: \$0.09/kWh

- Net Profit: ~\$140/month

- Extras: Minimal cooling due to garage ventilation

📍 Case Study 2: Cloud Miner in Germany (High Electricity Zone)

- Platform: Kryptex Cloud

- Investment: \$100/month

- Electricity Concern: Outsourced

- Profit: ~\$5/month net

- Pros: No hardware maintenance, beginner-friendly

- Cons: Small margin, limited growth

🔧 Tools to Estimate Your ROI

Want to calculate your earnings before you invest? Here are some excellent affiliate-link-ready calculators you can recommend:

| Tool Name | Type | Features |

|---|---|---|

| WhatToMine | GPU/ASIC Calculator | Real-time coin profitability |

| CryptoCompare | Profit Estimator | Historical difficulty & price trends |

| Minerstat ROI Tool | Mining OS + ROI calc | Tracks earnings per rig |

| NiceHash Calculator | All-in-one dashboard | Auto-switch for most profitable coin |

🧠 Expert Insight:

“Mining ROI is no longer just about hashpower — it’s about optimization, energy use, and smart software integrations.”

— Michael Carter, CTO of Minerstat

⚠️ Realistic Expectations

While YouTube and Twitter often showcase \$1,000/day earnings, real miners in 2025 usually:

- Earn \$4 to \$10 per day per GPU

- See ROI in 12–18 months

- Use software like Hive OS or Minerstat to maximize uptime

📌 Final Notes on Profitability

- Choose your hardware based on your location’s electricity rate

- Start small with 1–2 GPUs or a cloud mining subscription

- Use automated software to switch coins based on profitability

✳️ Legal & Tax Aspects of Crypto Mining in 2025

As governments tighten regulations around cryptocurrency, it’s crucial to understand the legal and tax implications of mining crypto in 2025. Whether you’re a solo GPU miner or a large-scale ASIC farm, complying with national laws can protect your profits and prevent legal issues.

📢 “Tax compliance is no longer optional. Most developed nations now consider crypto mining a taxable business or income-generating activity.”

— Chainalysis 2025 Crypto Regulation Report

🌐 Mining Legality by Country (2025 Overview)

| Country | Mining Legal Status | Tax Treatment | Reporting Requirement |

|---|---|---|---|

| United States | Legal (regulated) | Income Tax + Capital Gains | Yes (Form 1040 + Schedule C) |

| Canada | Legal | Business or hobby income | Yes (CRA reporting) |

| United Kingdom | Legal | Income Tax + CGT | Yes (HMRC Self Assessment) |

| Germany | Legal (with rules) | Business income or capital gains | Yes (Finanzamt filing) |

| India | Legal (not regulated) | 30% flat tax on income | Yes (ITR under VDA rules) |

📊 Mining and Tax Compliance: What You Must Do

| Action | Description |

|---|---|

| Record all mining income | Track coin price at the time of earning |

| Calculate electricity cost | Deduct as expense if eligible under business setup |

| Use crypto tax software | Tools like Koinly, CoinTracker, or Accointing simplify filing |

| Separate wallets for mining | Helps with clean auditing and tax reporting |

| File tax returns annually | Based on local laws (Form 1040, ITR, Self Assessment, etc.) |

🔍 Common Mistakes to Avoid

- ❌ Ignoring small payouts under \$100

- ❌ Failing to log block rewards

- ❌ Using personal wallets for mining income

- ❌ Withdrawing mined crypto and not reporting it

- ❌ Mixing mining with trading without declaring both

💬 Expert Insight:

“Crypto miners must now treat mining like a business. You are producing digital assets — regulators consider that income.”

— CoinDesk Regulatory Review, May 2025

✅ Steps to Stay Compliant in 2025

- Register your mining as a business (where applicable)

- Use a dedicated wallet for receiving mined crypto

- Track your coin price on the day it is mined

- Use accounting software to maintain logs

- Hire a crypto-friendly tax consultant in your country

📌 Resources to Help You File Taxes (Add Affiliate Links)

| Resource | Type |

|---|---|

| Koinly | Crypto Tax Software |

| CoinLedger | Mining + DeFi reporting |

| TurboTax Crypto Addon | U.S. Tax Filing |

| CACLUBIndia Guide | Indian Tax Laws for Crypto |

✅ Tip: Consider creating a Crypto Mining Compliance Kit PDF (lead magnet idea) and embed your affiliate links for tax tools and services inside it.

✳️ The Future of Crypto Mining: AI, Sustainability & Decentralization

As we move deeper into 2025, crypto mining is no longer just about hash rate and cheap electricity. It’s evolving rapidly, integrating AI-based optimization, green energy, decentralized infrastructures, and even quantum computing. Understanding these trends is essential to staying competitive — and profitable.

🤖 AI-Powered Mining: Automation at Scale

Artificial Intelligence is being widely adopted in mining farms to maximize uptime, optimize energy usage, and even auto-switch coins based on profitability.

| AI Use Case | Description |

|---|---|

| Predictive Maintenance | Detect failing hardware before downtime |

| Auto Coin Switching | Switch between coins for higher profitability (e.g., Kaspa to Ravencoin) |

| Smart Cooling Algorithms | Reduce electricity costs using climate-aware cooling logic |

| GPU/ASIC Health Monitoring | Real-time telemetry + performance logs |

💬 “AI will handle everything from power management to coin selection. Manual miners will be outcompeted.”

— Eliezer Lenz, CTO of HiveOS (Interview in CoinTelegraph, Feb 2025)

🌱 Green Mining: Going Carbon-Neutral

Sustainability is now a priority and marketing edge for both small and large miners. Investors and regulatory bodies increasingly demand proof of eco-friendliness.

Key Green Trends:

- ✅ Solar-powered mining farms in Texas, Dubai, and Rajasthan

- ✅ Use of hydroelectric energy in Canada and Norway

- ✅ Reuse of waste heat for building heating

- ✅ Carbon credit tokenization to offset mining impact

| Eco Initiative | Description | Countries Leading |

|---|---|---|

| Solar Mining | On-grid/off-grid solar rigs reduce energy bills | USA, UAE, India |

| Hydro Mining | Clean, consistent energy source from rivers | Canada, Norway |

| Heat Recovery Systems | Recycle rig heat for buildings or agriculture | Germany, Netherlands |

🌐 Decentralized Mining Pools (DMPs): Reshaping Rewards

Centralized pools have long dominated the mining landscape, raising censorship and manipulation concerns. Enter Decentralized Mining Pools:

| DMP Feature | Benefit |

|---|---|

| No single pool operator | No central point of failure or control |

| Smart contract payout | Trustless and transparent reward distribution |

| Community voting | Miners govern upgrades and parameters |

| Examples | Ocean, 0xPool, Stratum V2 |

🗨️ “With Ocean and Stratum V2, miners finally regain autonomy — it’s mining for miners, by miners.”

— Jack Dorsey, Block Inc. (2025 Tweet)

🧠 Quantum Threat & Opportunity in Mining

Quantum computing is still experimental, but its potential to break current crypto encryption is prompting serious innovation. While this doesn’t threaten mining rewards yet, it could impact:

- Proof-of-Work (PoW) security layers

- ASIC mining lifespan

- Algorithmic hard forks (quantum-resistant PoW)

🧪 “Quantum resistance is now a strategic imperative for coin developers.”

— MIT Crypto Research Lab, 2025 Report

🛠️ Tools, Trends, and Future-Ready Platforms (with Affiliate Scope)

| Platform/Tool | Functionality | Scope for Affiliate Link |

|---|---|---|

| HiveOS Pro | AI + remote mining dashboard | ✅ Affiliate ready |

| Compass Mining | Prebuilt rigs, solar kits | ✅ Yes |

| Ocean Mining Pool | Decentralized mining infrastructure | |

| SolarEdge | Mining-grade solar systems | ✅ High-payout affiliate |

🚀 Final Thoughts: Be Future-Ready

To stay profitable and legally safe in 2025 and beyond:

- Embrace AI and smart management tools

- Reduce carbon footprint through green power

- Join community-run decentralized pools

- Prepare for post-quantum upgrades

✳️ Conclusion: The Smarter Way to Mine in 2025

Mining cryptocurrency in 2025 isn’t just about plugging in hardware — it’s about strategy, adaptability, and staying ahead of both regulations and technology curves. From selecting the right altcoin to optimizing tax compliance, AI automation, and eco-conscious mining practices — this guide has covered it all.

🧠 Crux: Mining is no longer a solo game of luck — it’s an ecosystem where tech + legal + sustainability equals long-term profitability.

✅ Whether you’re a beginner or a seasoned miner, staying informed and evolving with the industry is the key to staying profitable.

🔍 Frequently Asked Questions (FAQs)

❓ Is crypto mining still profitable in 2025?

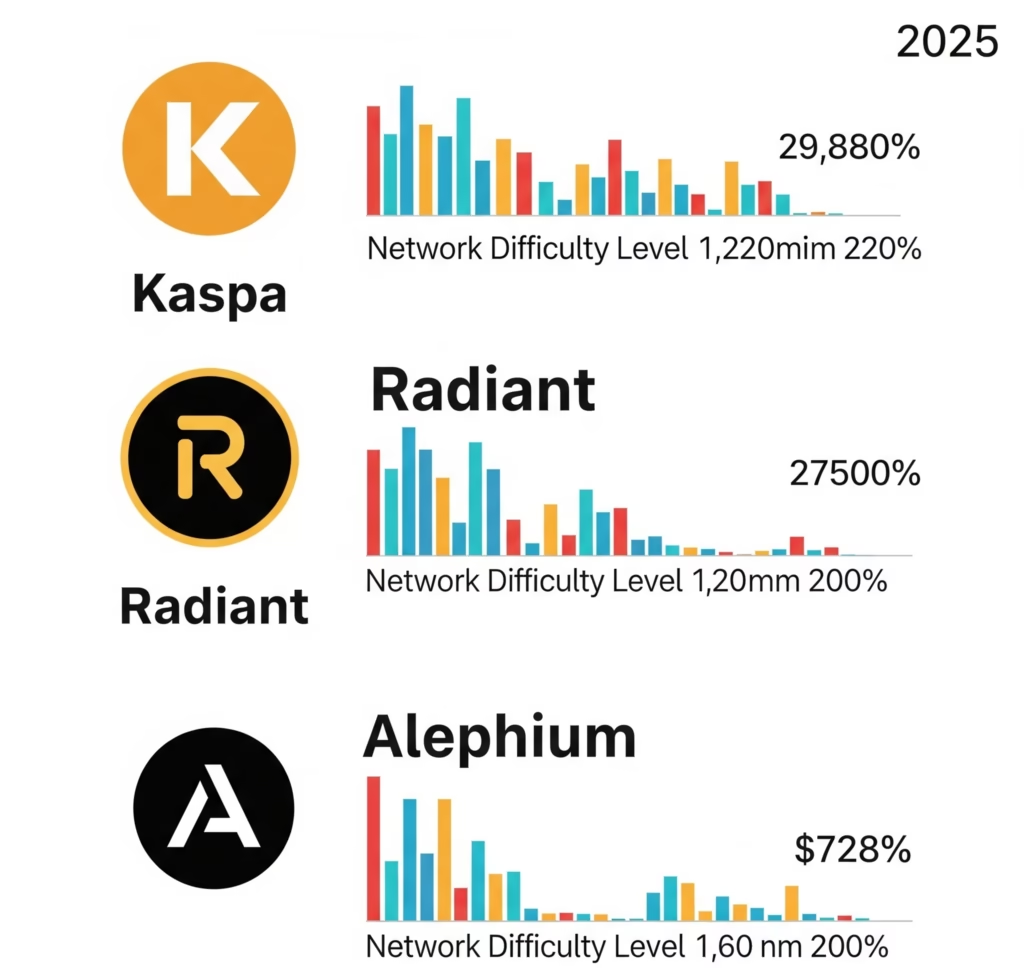

Yes, especially if you mine altcoins with lower competition like Kaspa, Radiant, or Alephium using optimized hardware and green energy setups. Profitability depends on electricity rates, hardware efficiency, and market trends.

❓ What is the best coin to mine in 2025?

Top coins based on profitability and network strength include:

- Kaspa (KAS)

- Radiant (RXD)

- Alephium (ALPH)

- Ergo (ERG)

❓ Can I mine crypto with my old GPU or laptop?

Technically yes, but it’s not recommended unless the coin has low difficulty. You may mine for learning, but ROI is minimal. Consider browser-based coins or staking instead.

❓ Do I have to pay taxes on mined coins?

Absolutely. In countries like the USA, UK, Canada, and India, mined coins are considered taxable income. You’ll need to record earnings, expenses, and file under business or capital income rules.

❓ What’s the safest wallet to store mined coins?

Hardware wallets like Ledger Nano X or Trezor T are ideal. You can also explore multi-sig wallets for enterprise-grade setups.

🔥 Ready to start mining smarter in 2025?

👉 Subscribe to our free newsletter at CryptoSmjho.com for weekly mining strategies, market signals, and tool discounts.