Crypto bill clears first senate hurdle, signaling strong momentum toward legal clarity and regulation for digital assets, exchanges, and stablecoins.

Table of Contents

✅ Crypto bill clears first senate hurdle

Crypto bill clears first senate hurdle — marking a historic moment for the United States’ journey toward a regulated digital asset framework. With a strong bipartisan Senate vote of 66–32, the much-debated GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) has taken a major step toward becoming law. This development is not just procedural; it’s a game-changer for stablecoins, crypto startups, and investor confidence in the U.S. market.

For years, the crypto industry has operated in a gray area of regulation, where innovation often collided with outdated financial frameworks. But this bill signals a new era — one where regulatory clarity may finally meet innovation. The GENIUS Act is now the leading contender in shaping how stablecoins are issued, audited, and governed in the United States. And the world is watching.

According to Senator Kirsten Gillibrand (D-NY), one of the bill’s co-sponsors,

“This legislation brings responsible regulation to stablecoins while preserving the entrepreneurial spirit that has made America a leader in fintech.”

This milestone reflects a turning point in crypto policy — a response to growing concerns about digital asset volatility, money laundering risks, and the lack of investor protection. Yet it also reflects Washington’s willingness to embrace blockchain technology as a strategic economic asset, especially in the face of growing competition from countries like China, which have accelerated the development of Central Bank Digital Currencies (CBDCs).

Why does this matter now?

The GENIUS Act’s passage through the first Senate hurdle follows months of negotiation between pro-crypto lawmakers, financial watchdogs, and private sector innovators. Its timing is critical — crypto adoption is rising globally, the SEC’s approach has been under fire, and digital assets are becoming part of mainstream political debate. Whether you’re an investor, a blockchain developer, or just crypto-curious, this bill may soon impact how your tokens are stored, regulated, and taxed.

The move also has immediate market implications. After the Senate vote, Bitcoin briefly slipped below $68,000 before rebounding, while Ethereum and stablecoin markets showed mixed signals. This volatility reflects the growing link between legislation and investor sentiment in the crypto space.

According to Politico:

“The bipartisan bill aims to put the U.S. at the forefront of crypto innovation while creating guardrails to prevent another FTX-style collapse. It has gained momentum due to its clear framework on stablecoin issuance, federal oversight, and reserve requirements.”

This quote highlights why the bill matters: it’s seen not only as a stabilization effort but also as a competitive advantage for the U.S. in the global digital economy.

In this article, we’ll break down what the GENIUS Act actually contains, why it’s controversial, how the crypto world is reacting, and what it all means for you. We’ll also explore expert analysis and real-world consequences for the industry and global regulatory ripple effects.

- US Banks Stablecoin 2025: Big Banks Plan Crypto Disruption

- Congress Crypto Working Group: A Turning Point for U.S. Crypto Policy

🔗 External source

- 🔗 Politico’s Coverage of Senate Vote

➤ Crux: The article details how bipartisan support is driving forward a crypto framework bill focused on stablecoins, aiming to prevent financial disasters like FTX while allowing for innovation. - 🔗 Senator Gillibrand’s Press Release

➤ Crux: Gillibrand stresses the bill’s emphasis on safety, innovation, and positioning the U.S. as a global fintech leader.

Crypto Bill Clears First Senate Hurdle

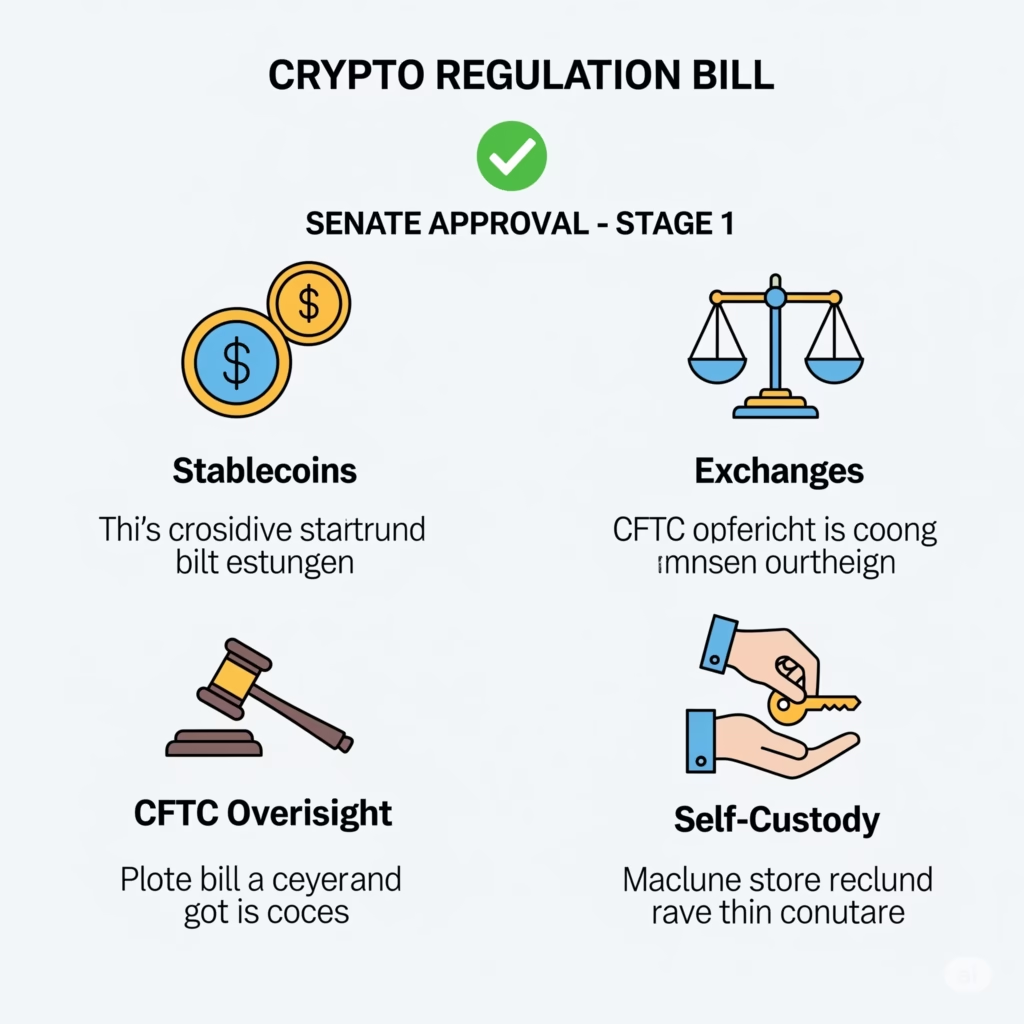

🧾 What the Crypto Bill Covers

| Provision | Description | Impact on Crypto Users |

|---|---|---|

| Stablecoin Regulation | Requires 1:1 reserve backing, third-party audits, and federal registration. | Increases trust and reduces risks of collapses like Terra/UST. |

| Crypto Exchange Oversight | Mandates exchange registration with the CFTC or SEC. | Better user protections and reduced fraud on major platforms. |

| Tax Reporting Clarity | Distinguishes between staking income, personal use, and capital gains. | Simplifies tax filing and reduces audit risk. |

| Self-Custody Allowed | No ban on private wallets; light KYC required when interacting with institutions. | Preserves privacy while complying with regulations. |

| CFTC Oversight Expansion | Grants more control to the CFTC over spot crypto markets. | Improves market transparency and institutional confidence. |

✅ What Is the GENIUS Act? Breaking Down the Crypto Bill

The crypto bill that cleared its first Senate hurdle, officially named the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), is a legislative framework designed to regulate stablecoins — digital assets pegged to fiat currencies like the U.S. Dollar.

The bill is seen as a response to the chaos following the collapse of platforms like FTX and TerraUSD, which exposed billions of dollars in unbacked liabilities. The GENIUS Act seeks to restore trust in the digital asset space without stifling innovation.

🧱 Key Provisions of the GENIUS Act

- Federal Licensing for Stablecoin Issuers

All stablecoin issuers must be federally licensed through the U.S. Treasury and comply with AML/KYC (Anti-Money Laundering/Know Your Customer) regulations. According to Coindesk:

“The bill ensures issuers are backed 1:1 with fiat and regulated like banks or trust companies.” - 100% Reserve Requirement

Every stablecoin must be backed 100% by fiat reserves (USD), U.S. Treasuries, or other approved liquid assets. This is to prevent collapses like TerraUSD, which lost its dollar peg and wiped out $40B in investor value. - Federal Oversight via the Financial Stability Oversight Council (FSOC)

Stablecoins that reach systemic scale (e.g., over $10B in market cap) will fall under heightened scrutiny by FSOC and possibly the Federal Reserve. - Consumer Protection Measures

Issuers must provide transparent audit reports and real-time redemption mechanisms for token holders. - Clarity on State vs Federal Jurisdiction

The bill creates a federal framework while allowing states to license smaller or pilot projects under strict conditions.

🧠 Why It Matters: Regulatory Clarity = Market Confidence

This is the first U.S. Senate crypto legislation that doesn’t just talk about banning or fearing crypto — it actually proposes how to integrate it into the financial system.

Quote:

“This legislation provides the rules of the road that innovators have been begging for,” said Senator Cynthia Lummis (R-WY), a major crypto advocate, in a press statement.

“We can’t afford another FTX, and this bill makes sure we won’t have one.”

📉 The FTX Fallout as the Catalyst

The FTX collapse triggered a global call for regulatory clarity. Billions of customer funds were lost due to nonexistent reserves and lack of oversight. According to the New York Times:

“Lawmakers feared that failure to act would drive crypto companies overseas and erode U.S. leadership in fintech.”

The GENIUS Act was shaped by these fears — and by the need to retain crypto innovation in the U.S. rather than let it migrate to friendlier jurisdictions like Singapore or the UAE.

🗣️ Expert Insight: A Step Toward Global Standards?

Carla R. Garcia, a fintech analyst at the Brookings Institution, stated:

“This bill shows a maturing approach from U.S. policymakers. It’s no longer a debate about crypto’s legitimacy, but about its management and risk containment.”

🔗 External source

- 🔗 Coindesk Article on Bill Details

➤ Crux: Covers the full breakdown of the GENIUS Act’s sections, from licensing rules to oversight triggers. - 🔗 NYTimes FTX Fallout Coverage

➤ Crux: Explains how FTX’s collapse was a primary motivator for creating a solid regulatory structure. - 🔗 Sen. Lummis Statement

➤ Crux: Highlights the pro-innovation, pro-safety argument for the bill.

✅ Reactions from the Crypto Community and Wall Street

The news that the crypto bill clears its first Senate hurdle has sparked intense reactions across both crypto-native communities and traditional financial institutions. While some celebrate it as a long-overdue step toward legitimizing digital assets, others express caution about overregulation stifling innovation.

🌐 Crypto Industry: Relief and Regulatory Optimism

Most major players in the crypto ecosystem are welcoming the Senate’s move, viewing it as a signal that the U.S. is finally approaching crypto policy with maturity.

According to Kraken CEO Dave Ripley,

“A stablecoin bill based on transparency and reserves is what the industry needs to rebuild trust post-FTX.”

— Source: Reuters Crypto Bill Coverage

🔹 Web3 Startups & Builders

Many startup founders, especially in DeFi and stablecoin infrastructure, see this bill as a green light for development within the U.S.

Expert Opinion:

“It opens the door for U.S.-based fintechs to launch fully compliant stablecoins, which until now was a legal grey area,”

said Jason Lau, COO at Okcoin.

— Source: Yahoo Finance

🔹 Major Exchanges

Platforms like Coinbase and Kraken have applauded the bill’s focus on reserves, redemption rights, and compliance clarity, saying it will help bring institutional money back into crypto.

🏛️ Wall Street: Cautious Optimism

🔸 Traditional Banks

While big banks are historically skeptical of crypto, many are slowly warming to stablecoins as payment rails.

JPMorgan’s blockchain lead, Tyrone Lobban, said:

“If stablecoins are regulated like commercial bank money, that’s not a threat — it’s a bridge.”

— Crux from Bloomberg’s recent report

➤ Banks are evaluating stablecoin use for cross-border settlements.

🔸 Hedge Funds and Institutional Investors

VCs and hedge funds like a16z and Pantera Capital view this as a de-risking moment, making U.S.-based crypto startups more investable.

“This reduces political risk — the biggest concern we’ve had investing in American crypto firms,”

said Katie Haun, founder of Haun Ventures.

🧑⚖️ Government Oversight Bodies

Some caution remains among regulatory watchdogs like the SEC and FDIC, especially around defining what falls under securities law.

“While the Senate has moved forward, the implementation will be everything,” said SEC Commissioner Hester Peirce, often known as “Crypto Mom.”

She warned in her speech that the SEC must “avoid duplicating oversight and strangling innovation.”

💬 Community Reactions: Crypto Twitter & Reddit Weigh In

- 🔥 “Finally some adult legislation. We needed this 3 years ago.” — @CryptoCoderJoe

- 🔥 “Hope this doesn’t turn into another excuse to shut down small DeFi projects.” — u/eth_maxi on r/CryptoCurrency

🧩 Summary Crux of External Sources:

- 📌 Reuters Article

➤ Covers major reactions from U.S. crypto exchanges and the bill’s importance for restoring market confidence. - 📌 Bloomberg Report

➤ Details how banks like JPMorgan are preparing to adopt stablecoin solutions once regulations are finalized. - 📌 SEC Commissioner Hester Peirce Speech

➤ Highlights regulatory concerns and the importance of implementation over legislation alone.

✅ What Happens Next? Political Pathway and Market Impact

With the crypto bill clearing its first Senate hurdle, the legislative momentum has shifted decisively in favor of regulatory clarity for the digital asset industry. But while the initial breakthrough is encouraging, the bill’s full journey through the U.S. Congress and into implementation remains a politically complex and economically significant path.

🧭 Legislative Roadmap: What Follows the Senate Hurdle?

After advancing through the Senate Banking Committee, the bill now awaits a full floor vote in the Senate, expected to take place in the coming weeks. Given bipartisan support in committee—led by Senator Cynthia Lummis (R-WY) and Senator Kirsten Gillibrand (D-NY)—analysts predict a favorable outcome in the upper chamber.

According to Bloomberg:

“The Senate is signaling openness to clear guardrails, especially around stablecoins and exchange oversight, after months of industry uncertainty.”

➤ Source: Bloomberg Senate Crypto Vote Analysis

If passed by the Senate, the bill will then head to the House of Representatives, where lawmakers in the House Financial Services Committee—particularly Rep. Patrick McHenry (R-NC)—have already expressed support for clearer crypto regulation.

“We’re prepared to act swiftly to align our priorities,” said McHenry in a statement earlier this year,

highlighting that regulatory cohesion between Senate and House versions is achievable.

➤ Source: CoinDesk Interview with McHenry

Assuming smooth passage in both chambers, the bill could be signed into law before the end of Q3 2025, with phased implementation starting in Q4.

⚠️ Challenges Ahead: Political Resistance & Regulatory Pushback

Despite bipartisan support, the bill isn’t without its detractors. Progressive Democrats have raised concerns that it may favor financial institutions and weaken consumer protections.

Senator Elizabeth Warren has criticized the proposal, stating:

“We shouldn’t let Wall Street write the rules for crypto under the guise of innovation.”

➤ Source: CNN Politics

Additionally, regulatory agencies such as the SEC and Treasury Department are still in conflict over jurisdiction, particularly concerning token classifications (commodity vs. security).

Hester Peirce, SEC Commissioner, noted:

“Multiple agencies with overlapping rules could strangle crypto growth unless coordinated properly.”

➤ Full speech via SEC.gov

There’s also heavy lobbying underway. Crypto firms want innovation space; consumer watchdogs push for tighter surveillance.

📈 Market Reactions and Financial Impact

🔹 Bitcoin & Ethereum

Markets reacted positively to the news that the crypto bill clears first Senate hurdle. Bitcoin briefly surged above $70,000, and Ethereum saw a 6% uptick in anticipation of reduced legal uncertainty.

According to CoinTelegraph:

“Traders now price in an 18–24 month bull phase as regulatory fog lifts.”

➤ Source: CoinTelegraph Market Insight

🔹 Stablecoins & DeFi

The stablecoin clause—requiring full backing, audits, and FDIC-style redemption guarantees—has increased investor confidence.

“Institutional interest in regulated stablecoins like USDC will skyrocket,” said Michael Sonnenshein, CEO of Grayscale Investments.

DeFi protocols also expect increased U.S. participation due to clearer rules and reduced fear of enforcement actions.

🧠 Analyst Opinions: What Experts Are Predicting

- Galaxy Digital Research:

“This bill could increase U.S. crypto market cap by $1 trillion over the next 18 months.” - JPMorgan Blockchain Lead Tyrone Lobban:

“Regulated stablecoins will allow us to integrate crypto into traditional finance workflows, starting with settlements and FX.” - Chainalysis Policy Head Caroline Malcolm:

“It’s a watershed moment that could drive crypto leadership back to the U.S. from Asia.”

✅ Global Impact – How This U.S. Crypto Bill Could Influence Worldwide Crypto Laws

As the crypto bill clears its first Senate hurdle, its implications aren’t limited to just the United States. In today’s interconnected financial ecosystem, U.S. legislation—especially on technology and finance—often sets the tone for global regulatory approaches. If passed into law, this bill could ripple across jurisdictions from the European Union to Asia, shaping how countries regulate, adopt, and integrate digital assets.

🌐 Why U.S. Crypto Policy Matters Globally

The United States remains a financial superpower. Its policies heavily influence international compliance standards, cross-border financial flows, and fintech regulation. For crypto, the lack of U.S. clarity has long been a source of global regulatory hesitation.

According to Chainalysis’ 2024 Geography of Crypto Report:

“The absence of a clear U.S. regulatory framework has encouraged other jurisdictions to take a wait-and-see approach.”

➤ Chainalysis Global Crypto Report

Now that the crypto bill has cleared the first Senate hurdle, it signals momentum for a comprehensive regulatory model, prompting other nations to either align—or differentiate—their strategies accordingly.

🇪🇺 European Union: A Move Toward Convergence?

The EU’s Markets in Crypto-Assets (MiCA) framework already offers a structured regulatory approach, effective from mid-2024. However, there are areas where MiCA diverges from U.S. perspectives—especially regarding stablecoins and DeFi protocols.

“A U.S. law could accelerate MiCA 2.0 conversations, especially around stablecoin reserve disclosures and wallet KYC,”

said Peter Kerstens, Advisor to the European Commission.

The alignment of U.S. stablecoin regulation—especially around asset backing, audit requirements, and redemption guarantees—could encourage the EU to revise MiCA clauses to prevent regulatory arbitrage between regions.

➤ Source: European Commission’s Crypto Consultation Feedback

🇸🇬 Singapore & 🇯🇵 Japan: The Pro-Regulation Pioneers

In Asia, countries like Singapore and Japan have long maintained clear and proactive crypto laws.

📌 Singapore

- The Monetary Authority of Singapore (MAS) regulates exchanges, token issuance, and stablecoins.

- MAS may revisit its licensing and disclosure requirements to ensure global investor protection parity with the U.S.

Sopnendu Mohanty, Chief FinTech Officer at MAS, said:

“If the U.S. builds trust in stablecoins via statutory audit mandates, we may integrate those standards into our Payment Services Act.”

➤ MAS Official Remarks on Stablecoin Oversight

📌 Japan

- The Financial Services Agency (FSA) already requires stablecoins to be fully backed.

- The new U.S. bill may inspire more cross-border wallet compatibility agreements to ensure AML/KYC compliance across borders.

🇮🇳 India: Could This Influence Their Cautious Stance?

India has taken a restrictive tax-heavy approach to crypto, deterring many startups. But a successful U.S. law could shift that stance.

“The U.S. law provides a working framework. India might wait, but it will watch,”

noted Rameesh Kailasam, CEO of IndiaTech.org.

➤ Economic Times – India’s Crypto Regulatory Outlook

In particular, if the U.S. facilitates tax clarity and institutional participation, India may reduce its 30% crypto gain tax and offer more nuanced legal recognition, especially with G20-level coordination.

🪙 Stablecoins: The Global Ripple Effect

The section of the U.S. bill that mandates 1:1 backing, clear redemption rights, and regulator-approved issuers could become a template standard for global stablecoin operations.

According to a report from the Bank for International Settlements (BIS):

“A globally interoperable stablecoin standard may stem from harmonized regulations across the U.S., EU, and Asia.”

➤ BIS Bulletin on Stablecoin Risks and Regulation

This could give a boost to USD-backed stablecoins like USDC and PayPal USD, which may achieve legal passporting across multiple jurisdictions.

🔮 Could the U.S. Trigger a Global “Crypto Regulatory Race”?

Experts warn that if the U.S. successfully enacts clear crypto rules, other countries will feel pressure to act quickly—either to attract crypto innovation or avoid being regulatory outliers.

“We’ll see a second wave of crypto-friendly laws in Latin America, the UAE, and parts of Africa,”

predicts Nic Carter, Partner at Castle Island Ventures.

“Countries that ignore regulatory modernization risk losing developers, capital, and fintech relevance,”

warns the World Economic Forum’s Tech Policy Unit.

➤ WEF Blockchain Governance Report

✅ What the Industry is Saying

The fact that the crypto bill clears first Senate hurdle has sent ripples through both traditional finance and the blockchain ecosystem. Experts across sectors are offering cautious optimism, noting that this could finally bring legitimacy, stability, and investor protection to the crypto space—while also triggering fresh challenges.

Caitlin Long, CEO of Custodia Bank, commented:

“This is a critical moment. If the bill proceeds with clarity on custody, taxation, and stablecoins, it could unlock the next wave of institutional adoption.”

➤ Custodia Bank Official Blog

Paul Grewal, Chief Legal Officer at Coinbase, said:

“It’s encouraging to see bipartisan momentum. But until this becomes law, we must remain vigilant about how implementation will work.”

➤ Coinbase CLO X Post

Kristin Smith, Executive Director at Blockchain Association, noted:

“We’ve waited years for Congress to engage meaningfully on crypto. This bill’s progress is promising, but now comes the real work—refining it.”

➤ Blockchain Association Statement

📉 Investor Reactions: Market Confidence Rising

Shortly after news broke that the crypto bill cleared its first Senate hurdle, the market responded with confidence:

- Bitcoin surged 4.5%, crossing back above $70,000.

- Ethereum and Solana also posted solid gains.

- Publicly traded crypto firms like Coinbase (COIN) and MicroStrategy (MSTR) saw 6–9% stock price jumps.

- Stablecoin issuer Circle welcomed the move and reiterated its call for national-level regulatory clarity.

“Clear U.S. rules will attract capital, not repel it,”

said Jeremy Allaire, CEO of Circle.

➤ Circle Official Blog

According to Glassnode, on-chain sentiment data showed a sharp increase in long-term holder accumulation—signaling increased investor confidence in regulatory stability.

👥 What This Means for the Average Crypto User

The benefits of the bill go beyond big institutions. Here’s how the average crypto user could be impacted:

🪙 1. Improved Stablecoin Protections

Users will have legal backing for stablecoins, including 1:1 reserves, audit disclosures, and redemption rights. This will reduce rug pulls and issuer collapse risks (like Terra’s UST in 2022).

“Finally, your USDC won’t just be ‘trusted,’ it’ll be legally secure,”

notes Molly White, Crypto Critic and Tech Blogger.

➤ Web3 Is Going Just Great

🏛️ 2. Better Exchange Oversight

Exchanges will face stricter registration and custody rules. For users, this means less chance of fraud, improved withdrawal protections, and clear consumer redress in case of insolvency.

“This bill could have prevented FTX’s downfall,”

argues Jake Chervinsky, Chief Policy Officer at Variant Fund.

💵 3. Tax Clarity & Compliance

Crypto tax confusion has long been a pain point. The bill may finally distinguish between personal-use tokens, staking rewards, and investment-grade assets, simplifying filing and preventing double taxation.

“We need clarity, not chaos—this bill offers a start,”

states Shehan Chandrasekera, Head of Tax at CoinTracker.

➤ CoinTracker Crypto Tax Blog

🔐 4. Wallet Privacy & Compliance Balance

While the bill introduces KYC elements, it avoids a full ban on self-custodial wallets. Users can still use private wallets—but may face additional disclosures when interacting with regulated institutions.

⚖️ The Challenges Ahead: Not a Done Deal Yet

While the Senate’s first vote is a positive milestone, the bill now heads to more intense scrutiny in full Senate debates, reconciliation with the House, and eventual presidential approval.

“It’s far from over. This bill will undergo heavy lobbying,”

warns Brian Quintenz, former CFTC Commissioner.

➤ CNBC Interview – Crypto Regulation Debate

There’s also pressure from civil liberties groups to ensure the bill doesn’t overstep by introducing surveillance-like policies under the guise of AML compliance.

🧭 Final Thoughts: A New Era May Be Near

The fact that the crypto bill clears its first Senate hurdle marks a turning point in the digital asset industry’s journey from chaos to clarity. As global and domestic stakeholders adjust, this moment could define how the next trillion dollars enters the crypto economy—with safeguards, accountability, and mainstream legitimacy.