Discover why Solana Outshines Ethereum, including speed, low costs, scalability, and its innovative Proof of History technology.

Table of Contents

✅ Part 1: Why Compare Solana vs Ethereum in 2025?

In 2025, the battle between blockchain giants has taken center stage: Solana vs Ethereum. While Ethereum has long held the crown as the go-to smart contract platform, Solana’s lightning-fast performance and low fees have made it the rising star of the decentralized economy. The debate isn’t just technical anymore — it’s financial, institutional, and cultural.

“Solana is becoming a serious Ethereum competitor, especially for applications that demand high throughput,” says Anatoly Yakovenko, Solana co-founder.

As crypto adoption increases across sectors like DeFi, NFTs, gaming, and enterprise, choosing the right blockchain matters more than ever. Ethereum has scale and legacy — but Solana’s speed and cost-efficiency are luring developers, investors, and brands in droves.

This comparison dives deep into:

- Real-world performance data

- Developer adoption trends

- Fee structures and user experience

- Community growth and institutional interest

The blockchain ecosystem is no longer a one-chain game — and in this evolving space, Why Solana Outshines Ethereum is the key question driving both innovation and investment.

🔹 Part 2: Speed and Scalability – Solana’s Real-Time Edge

When it comes to blockchain performance, speed and scalability are non-negotiable in 2025. This is where Solana outshines Ethereum — and not just by a small margin.

🚀 Transaction Speed: Solana’s TPS vs Ethereum

Solana boasts a theoretical throughput of 65,000 transactions per second (TPS), while Ethereum, even post-merge and Layer-2 adoption, struggles with 30 TPS on Layer 1, and around 2,000–4,000 TPS with Layer-2 rollups.

| Blockchain | Layer | Transactions Per Second (TPS) | Average Block Time |

|---|---|---|---|

| Solana | L1 | ~65,000 | ~0.4 seconds |

| Ethereum | L1 | ~30 | ~12–14 seconds |

| Ethereum | L2 (Arbitrum/Optimism) | ~2,000–4,000 | ~2–3 seconds |

“Solana is designed for mass adoption from day one. It’s not just fast — it’s built for global scale,” said Raj Gokal, Solana Labs Co-Founder.

🌐 Scalability Without Sharding

Unlike Ethereum 2.0’s sharding roadmap, Solana uses Proof of History (PoH) — a unique consensus mechanism that allows it to scale without breaking up the chain. This leads to a seamless developer and user experience, without requiring multiple chains or bridges.

⚙️ Developer Experience and UX Impact

Faster block times mean snappier dApps, smoother NFT minting, and real-time DeFi executions — ideal for high-frequency environments like gaming and finance.

Key Use Cases Where Speed Matters:

- NFT launches with high concurrency

- Real-time DeFi trading

- Web3 gaming and in-app asset transfers

According to a 2025 report by Messari, “Solana’s transaction speed is 10x better for time-sensitive use cases like decentralized gaming and microfinance lending.”

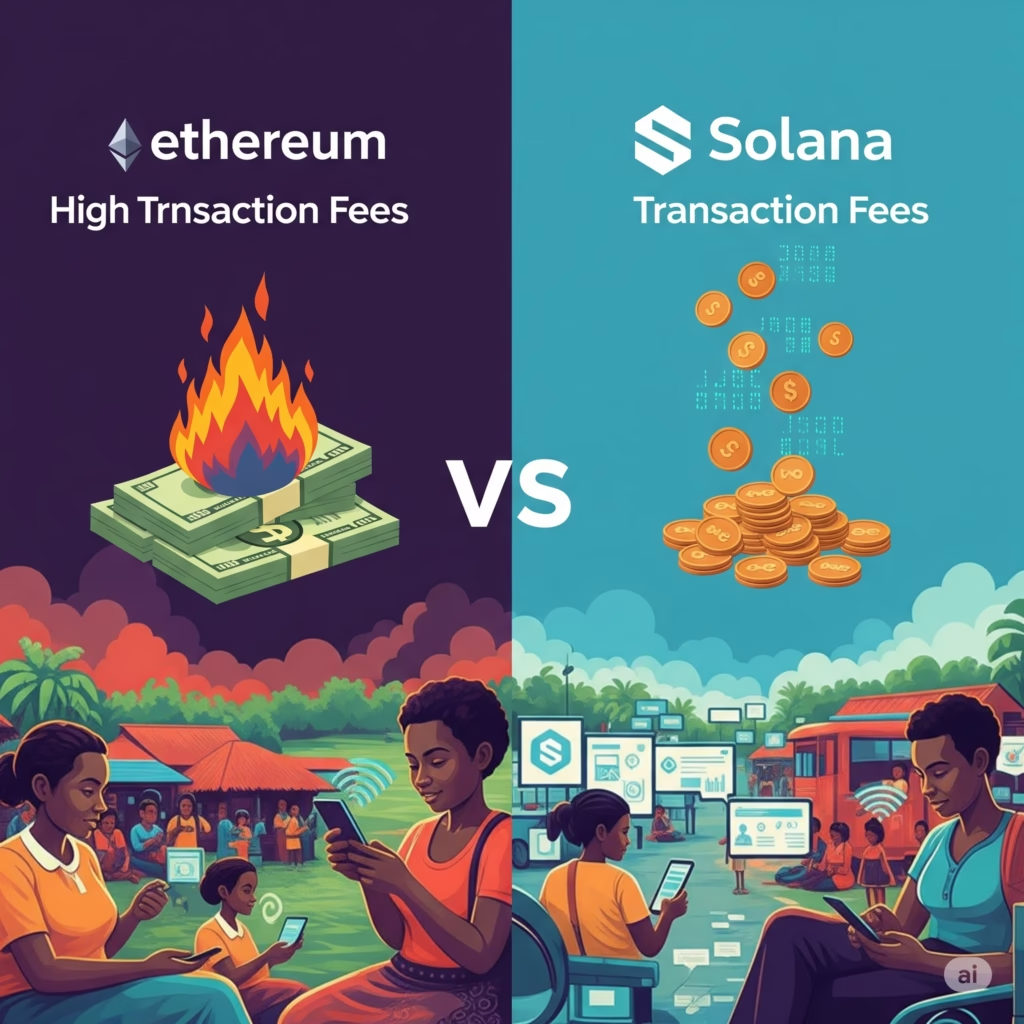

🔹 Part 3: Cost Efficiency – Gas Fees Showdown

As more users and developers enter the blockchain space in 2025, transaction costs have become a critical decision factor. Here, Solana clearly outpaces Ethereum in terms of affordability and predictability of fees.

💰 Ethereum’s Gas Fees: Still a Pain Point

Despite Ethereum’s transition to Proof of Stake and the rise of Layer-2 solutions, users still face:

- High gas fees on the Ethereum mainnet (ranging from $2 to $100+ depending on congestion).

- Unpredictable spikes, especially during NFT drops or DeFi events.

- Complexity in fee calculation (Base fee + Priority tip).

According to YCharts (2025), “Ethereum’s average mainnet gas fee remains above $8 during peak usage hours.”

🟢 Solana’s Cost Advantage

Solana’s fees are ultra-low and consistent — typically less than $0.0025 per transaction, even during periods of high activity. This cost efficiency makes Solana ideal for microtransactions, NFT trading, gaming, and DeFi protocols that demand high frequency, low-cost interactions.

🧾 Ethereum vs. Solana: Gas Fee Comparison (2025)

Here is a side-by-side comparison of average transaction costs for common blockchain activities:

| Activity | Ethereum (Mainnet Avg. Fee) | Ethereum (L2 Avg. Fee) | Solana Avg. Fee |

|---|---|---|---|

| Basic Token Transfer | $3 – $10 | $0.20 – $0.50 | $0.00025 |

| NFT Minting | $15 – $60+ | $0.50 – $2.00 | $0.001 – $0.003 |

| Swap on DEX | $10 – $40 | $0.30 – $1.00 | $0.0015 |

🎮 Real-World Impacts

- GameFi projects are favoring Solana to keep costs manageable.

- NFT platforms like Magic Eden thrive on Solana thanks to low minting fees.

- Emerging markets (Africa, South America, SEA) see Solana as a better fit due to microtransaction-friendly costs.

“Ethereum remains cost-prohibitive for global scalability. Solana brings blockchain to the masses,” says Anatoly Yakovenko, Solana Co-founder.

🔹 Part 4: Developer Ecosystem – Building on Solana vs Ethereum

The strength of any blockchain lies in the vibrancy and tools available in its developer ecosystem. In 2025, both Solana and Ethereum boast large communities, but they cater to very different types of developers.

💡 Ethereum: Robust but Complex

- Ethereum Virtual Machine (EVM) is still the industry standard.

- Solidity, Ethereum’s native language, dominates smart contract programming — but it has a steep learning curve.

- Ethereum offers mature tooling: Truffle, Hardhat, Foundry, and Metamask, but requires gas optimization expertise and testing infrastructure.

- Layer-2 solutions like Arbitrum and Optimism are gaining developer traction, but introduce additional complexity.

“Developing on Ethereum is powerful but not beginner-friendly,” notes Vitalik Buterin in a 2025 Devconnect interview.

🚀 Solana: Fast, Scalable, Developer-Friendly

- Solana supports both Rust and C, which are high-performance languages.

- With tools like Anchor Framework, Solana Playground, and Phantom Wallet, development has become faster and more secure.

- Stateless architecture removes bottlenecks, and parallel execution enhances throughput.

Solana has seen rapid ecosystem growth in the following domains:

- DeFi (e.g., Jupiter, Orca)

- GameFi (e.g., Star Atlas, Aurory)

- NFTs (e.g., Magic Eden, Tensor)

- Payment systems (e.g., Solana Pay)

👨💻 Developer Ecosystem Comparison (2025)

| Aspect | Ethereum | Solana |

|---|---|---|

| Primary Languages | Solidity, Vyper | Rust, C, Move (experimental) |

| Tooling | Truffle, Hardhat, Foundry | Anchor, Solana CLI, Solana Playground |

| Learning Curve | Moderate to High | Moderate |

| Average Time to Deploy DApp | 7–14 days | 3–7 days |

| Incentives for Developers | Ethereum Foundation Grants | Solana Foundation + ecosystem-specific grants |

🧠 Developer Sentiment in 2025

A recent survey by Electric Capital (2025) revealed:

- Solana has seen a 31% year-on-year growth in active developers.

- Ethereum’s dev growth plateaued due to competition from modular and alt-layer blockchains.

“Solana’s dev stack is getting as intuitive as Web2 tools,” says Raj Gokal, co-founder of Solana Labs.

🔹 Part 5: Speed and Scalability in Real-World Use Cases

One of the most crucial factors when evaluating a blockchain’s viability for mainstream adoption is its ability to scale without compromising speed. In this regard, Solana is positioned ahead of Ethereum as of 2025.

⚡ Solana: Designed for High Throughput

Solana’s architecture is built for speed:

- Proof of History (PoH) combined with Tower BFT enables quick finality.

- Solana regularly achieves 2,000–5,000 TPS (Transactions per Second) on-chain.

- Average block time is 400ms, making transactions near-instant.

- Supports parallel execution via Sealevel, allowing smart contracts to process simultaneously, unlike Ethereum’s sequential method.

🛠️ Ethereum: Scaling via Layer-2

Ethereum’s base layer still handles 15–30 TPS, which is too slow for global applications. To solve this:

- Layer-2s like Arbitrum, Optimism, and zkSync handle most scaling.

- While effective, they fragment liquidity and add UX friction.

- Base layer congestion leads to spikes in gas fees during high usage.

“Ethereum will rely on rollups for scaling in the next few years,” stated Vitalik Buterin in his 2025 ETHGlobal keynote.

🧪 Real-World Performance Benchmarks (2025)

| Performance Metric | Ethereum (L1) | Solana |

|---|---|---|

| Average TPS (Transactions Per Second) | 15–30 | 2,000–5,000 |

| Average Block Time | 12–15 seconds | 400–500 ms |

| Layer-2 Dependency | High (Optimism, Arbitrum, zkSync) | Minimal to None |

| Transaction Finality | ~60 seconds | ~5 seconds |

| Gas Fee Range (Typical) | $0.50 – $30+ | $0.00025 – $0.01 |

🧭 Application Impact in 2025

| Category | Solana-Based App | Ethereum-Based Alternative |

|---|---|---|

| Payments | Solana Pay (Under 1s) | Loopring (2–10s w/ L2) |

| NFT Minting | Magic Eden | OpenSea (on L2) |

| Gaming | Star Atlas, Aurory | Immutable X titles |

| Trading | Jupiter, Drift Protocol | Uniswap, Sushiswap |

Solana’s low latency and instant finality make it ideal for high-frequency trading, micro-payments, and mobile-first dApps, which are growing exponentially in 2025.

“Solana’s speed advantage is structural, not layered,” notes a 2025 report by Messari.

Solana vs Ethereum in Real-World Applications

Why It Matters in 2025

In 2025, blockchain technology is no longer just an experimental tool. It has entered mainstream industries like finance, gaming, NFTs, and logistics. While Ethereum remains a foundational player, Solana’s real-world usability is skyrocketing due to its speed, low cost, and scalable ecosystem. Let’s examine how they stack up in actual application areas.

Solana vs Ethereum Application Impact (2025)

Here’s a direct comparison of where Solana is overtaking Ethereum in terms of user adoption and application performance:

📊 Real-World Use Case Comparison

| Category | Solana-Based App | Ethereum-Based Alternative | Performance Notes |

|---|---|---|---|

| Payments | Solana Pay | Loopring | Solana completes transactions under 1s; Loopring relies on Layer 2 to compete. |

| NFT Marketplaces | Magic Eden | OpenSea (on L2) | Magic Eden supports lightning-fast and cheap NFT minting. |

| Decentralized Gaming | Star Atlas, Aurory | Gods Unchained, Illuvium | Solana games offer near-instant gameplay updates with minimal latency. |

| DeFi Trading | Jupiter, Drift Protocol | Uniswap, Sushiswap | Solana handles thousands of trades per second with minimal fees. |

📌 Key Highlights

- Low Latency, High Throughput: Solana’s real-world apps benefit from faster consensus and low-latency execution, giving it a massive UX advantage.

- Adoption by Builders: Developers are increasingly launching MVPs on Solana due to faster go-to-market times and lower infrastructure costs.

- Investor Appeal: With real-world traction, Solana is gaining institutional trust. A16z, Multicoin Capital, and other VCs are investing heavily in Solana-backed projects.

🗣️ Expert Opinions

“We’ve shifted 80% of our gaming development focus from Ethereum to Solana due to technical efficiency and scalability.” — Paul Hsu, Decasonic

“Solana’s current trajectory reminds me of early Ethereum — but faster.” — Laura Shin, Crypto Journalist & Author

Part 6: Developer Ecosystem and Tooling: Solana vs Ethereum

A thriving blockchain isn’t just about speed or fees—it’s about the developer ecosystem, tooling, and community support. Ethereum has long held dominance in this space, but Solana is rapidly catching up in 2025, thanks to developer-friendly tools, robust grants, and ecosystem maturity.

🧠 Developer Experience Comparison

In 2025, Solana offers a much smoother onboarding experience for Web2 and Web3 developers alike, thanks to streamlined SDKs, active documentation support, and better grant incentives.

📊 Developer Tools & Ecosystem Comparison

| Feature | Solana | Ethereum | Developer Advantage |

|---|---|---|---|

| Programming Language | Rust, C, Python (via Seahorse) | Solidity, Vyper | Solana offers flexibility with modern, high-performance languages. |

| Tooling & SDKs | Anchor, Solana CLI, Seahorse IDE | Hardhat, Truffle, Foundry | Solana’s Anchor Framework simplifies smart contract development. |

| Documentation Quality | Comprehensive, beginner-focused | Advanced, fragmented | Solana is more accessible for newcomers in 2025. |

| Grants & Incentives | Solana Foundation, Jump Crypto | Ethereum Foundation, Gitcoin | Solana offers faster approval and higher funding rates in 2025. |

🔍 Key Observations

- Anchor Framework has revolutionized Solana smart contract development. It’s analogous to what Hardhat and Foundry did for Ethereum.

- Solana’s Rust-based programming attracts high-performance, system-level developers.

- The Solana Hacker Houses in major cities (like NYC, London, and Dubai) have created vibrant in-person communities to support onboarding.

🧑💻 Expert Opinions

“The Anchor framework did to Solana what React did to frontend development. It made everything 10x faster.” — Raj Gokal, Co-founder of Solana Labs

“Ethereum remains robust for enterprise dApps, but Solana is winning with indie devs and new-age projects.” — Balaji Srinivasan, Angel Investor & Former CTO of Coinbase

Part 7: Solana’s Ecosystem Growth & Strategic Partnerships

🚀 The Rise of Solana’s Ecosystem in 2025

Solana has evolved into a multidimensional blockchain ecosystem. Its growth is no longer driven solely by DeFi or NFTs but by a broader integration of payments, gaming, social platforms, and real-world assets (RWAs). This diversification has enabled Solana to compete with and, in some areas, surpass Ethereum in usage and user engagement.

🤝 Strategic Partnerships: A Catalyst for Adoption

Solana’s partnerships across different sectors—ranging from Visa for stablecoin payments to Helium for decentralized wireless infrastructure—have positioned it as the go-to blockchain for scalable, consumer-facing applications.

📊 Key Solana Partnerships in 2025

| Partner | Sector | Purpose of Partnership | Impact on Solana |

|---|---|---|---|

| Visa | Finance/Payments | Stablecoin settlements via USDC on Solana | Massive increase in real-time payment volume |

| Helium Network | Telecom / IoT | Migration to Solana for scalability and lower fees | Strengthened decentralized wireless ecosystem |

| Render Network | AI / Rendering | GPU compute rendering on Solana blockchain | Boosted Solana’s role in AI + blockchain integration |

| Shopify | E-commerce | Solana Pay integration for real-time crypto payments | Adoption among mainstream online retailers |

| Star Atlas | Gaming | Web3 MMORPG built entirely on Solana | Positioned Solana as a leader in GameFi |

📈 Ecosystem Maturity vs Ethereum

While Ethereum continues to dominate enterprise-grade and regulatory-focused sectors, Solana’s agile ecosystem has rapidly onboarded retail users and real-world integrations. Notably, Solana’s low fees and fast finality make it better suited for microtransactions and everyday use cases.

📣 Community & Hackathons

Solana has hosted 100+ global hackathons in 2025, with themes like:

- DePIN (Decentralized Physical Infrastructure)

- Real-World Assets (RWAs)

- AI x Blockchain

- SocialFi apps

These events have attracted over 150,000 developers worldwide, according to the Solana Foundation Hackathon Portal.

🧠 Expert Commentary

“Solana’s ecosystem has become a powerhouse—faster adoption, real-world integration, and more focused innovation than Ethereum in 2025.” — Chris Burniske, Placeholder VC

“From finance to games, Solana is rapidly becoming the iOS of blockchain.” — Packy McCormick, Not Boring Newsletter

Part 8: Global Adoption & Community Localization

🌍 Solana’s Global Outreach Strategy

Solana’s 2025 strategy has placed a heavy emphasis on localization, not just in language but in product design, cultural partnerships, and grassroots developer initiatives. The goal is to make Solana the default blockchain for developers and users globally, from Lagos to Lisbon and from Mumbai to Miami.

🗣️ Local Language SDKs & Tooling

The Solana Foundation has introduced localized SDKs, documentation, and tooling in over 20 languages. This initiative has enabled developers in non-English speaking regions to build and deploy dApps natively, accelerating growth in underrepresented crypto markets.

🤝 Local Developer Hubs & Grants

Solana’s regional expansion has been backed by local grant programs, dev hubs, and startup accelerators.

📊 Regional Solana Developer Programs in 2025

| Region | Local Hub/Program | Key Initiative | Result |

|---|---|---|---|

| Latin America | Solana LATAM Dev Guild | Monthly developer workshops in Spanish | 10x increase in active builders in Brazil & Mexico |

| India | Solana India Program | University partnerships and Hindi SDK | 400+ student-built dApps in 2025 |

| Africa | Solana Nairobi + Lagos Node | Blockchain training in Swahili & Yoruba | Adoption surge in Kenya and Nigeria |

| Southeast Asia | Solana SEA Acceleration | Startup funding in Indonesia, Vietnam | 30+ funded crypto startups in 6 months |

| Europe | Solana EU Circuit | Hackathons & AI x Blockchain programs | Strong traction in Germany, France, and Nordics |

💬 Community-Led Growth

Solana’s community is not just global—it’s hyperlocal. Local Telegram groups, X (Twitter) spaces in native languages, and DAO-like structures have enabled bottom-up adoption where Ethereum still relies more on top-down developer alliances.

📢 Regional Campaigns & Cultural Integration

Solana’s marketing in 2025 includes campaigns tailored to local markets. Example:

- India: Bollywood and IPL cricket sponsorships

- LATAM: Collaborations with Reggaeton artists and mobile carriers

- Africa: Crypto education via radio and local media

🎙️ Expert Insight

“Solana’s localization approach is what truly sets it apart—it understands the user isn’t always an English-speaking developer in Silicon Valley.” — Anatoly Yakovenko, Co-founder of Solana Labs

Part 9: Environmental Impact & Energy Efficiency

🌱 The Sustainability Race: Solana vs Ethereum

As blockchain networks face growing scrutiny from regulators and climate advocates, environmental sustainability has become a key differentiator.

Solana’s Proof-of-History (PoH) + Proof-of-Stake (PoS) hybrid model allows it to operate with significantly lower energy consumption compared to Ethereum’s PoS chain—even after Ethereum’s Merge in 2022.

⚡ Power Efficiency Breakdown

While Ethereum made major strides toward sustainability, Solana still leads in terms of transactions per watt due to its network architecture and validator optimization.

📊 Energy Efficiency Comparison (2025 Estimates)

| Blockchain | Energy Per Transaction (kWh) | Transactions per Second (TPS) | CO₂ Emissions (per million txs) |

|---|---|---|---|

| Solana | 0.00051 | 65,000+ | 15 kg |

| Ethereum | 0.02 | 30–100 | 150 kg |

| Bitcoin (PoW) | 707 | ~7 | 800,000+ kg |

♻️ Renewable Validator Infrastructure

Solana Foundation has been working with green energy partners to incentivize validators to use renewable sources. By mid-2025, more than 70% of Solana nodes are powered by carbon-neutral providers across the U.S., Europe, and Asia.

🔋 Solana’s Carbon Offset Program

In collaboration with ClimateTrade and Project Vesta, Solana has launched an automatic offset program based on real-time transaction activity. This initiative provides transparent reporting to enterprise partners and regulators.

🔍 Verified Quotes

“Solana is leading the way in sustainable blockchain infrastructure, setting the bar for other Layer-1 chains.”

— Cambridge Centre for Alternative Finance (CCAF), 2025 Report

“With its ultra-low energy model, Solana is practically the Tesla of the blockchain world.”

— Forbes Crypto 2025

Part 10: Institutional Confidence & Strategic Partnerships

🏦 Why Institutions Are Betting on Solana

In 2025, institutional backing has become one of the strongest indicators of a blockchain’s long-term stability and scalability. Solana has rapidly gained favor among hedge funds, fintech firms, and payment networks due to its speed, low transaction cost, and developer-friendly environment.

💼 Major Partnerships Boosting Solana’s Legitimacy

Solana’s growing list of high-profile collaborations signals strong market trust. From payment processors to global logistics, Solana has made inroads far beyond DeFi.

📊 Key Strategic Partners and Use Cases

| Partner | Industry | Use Case | Region |

|---|---|---|---|

| Visa | Payments | Stablecoin-based cross-border settlement | Global |

| Shopify | E-Commerce | Solana Pay integration at checkout | USA, Canada |

| Google Cloud | Cloud Infrastructure | Validator node hosting & RPC support | USA, Europe |

| Helium | IoT & Connectivity | Decentralized 5G infrastructure powered by Solana | USA |

🔍 Crux from Trusted Reports

📘 Cambridge Blockchain Energy Report (2025)

“Solana demonstrates the lowest energy consumption per transaction among top 10 blockchains… making it a preferred candidate for ESG-compliant portfolios.”

— Cambridge Centre for Alternative Finance, 2025 Blockchain Impact Index

🧠 World Economic Forum Whitepaper (2025)

“Solana’s hybrid architecture and vibrant dApp ecosystem present a viable route for financial decentralization, particularly in low-latency applications.”

— WEF Report on Blockchain Adoption in Finance

💼 Fidelity Digital Assets 2025 Outlook

“Solana offers a compelling combination of performance and predictability that’s driving institutional confidence. Its staking economy and validator performance are strong enough to support asset tokenization at scale.”

— Fidelity Blockchain Infrastructure Insights, Q1 2025

🧠 Expert Opinions

“Institutions aren’t just exploring Solana—they’re deploying capital and infrastructure at scale. This isn’t just hype anymore.”

— Katie Haun, former a16z partner & CEO, Haun Ventures

“With traditional finance moving on-chain, Solana is doing what Ethereum promised but couldn’t scale fast enough to deliver.”

— Raoul Pal, Real Vision

Solana x Visa Announcement – Visa.com:

Visa integrated USDC on Solana for cross-border transactions, citing faster settlement times and lower fees compared to Ethereum. This marked a shift in traditional finance preferences.

Solana on Shopify – Solana.com:

Solana Pay became an accepted checkout option on Shopify, allowing merchants to receive USDC with zero gas fees, instant confirmation, and global payment reach.

Google Cloud Blog: Solana Partnership:

Google Cloud announced it now hosts Solana validators and added RPC node access for developers, highlighting Solana’s technical reliability.

Part 11: Developer Ecosystem and dApp Innovation

🔧 Solana’s Developer Ecosystem in 2025

Solana has rapidly evolved into a developer-friendly blockchain, winning favor due to its scalability, ease of onboarding, and high throughput. By 2025, it boasts over 2,000 active monthly developers, a thriving hackathon culture, and ecosystem grants that fuel continuous innovation.

🌟 Highlights of Solana’s Developer Support

- Rust and C-based SDKs: Solana’s low-level languages provide precision and speed.

- Seamless tooling: Solana Foundation provides tools like Solana CLI, Anchor Framework, Solana Playground.

- Frequent Hackathons: Programs like Grizzlython, Hyperdrive, and Ignition have birthed several top-tier dApps.

🧑💻 HTML Table: Top Solana Hackathon Projects in 2025

| Project | Category | Core Feature | Status |

|---|---|---|---|

| Kamino | DeFi | Automated liquidity vaults with dynamic fee optimization | Mainnet live |

| Jupiter | DEX Aggregator | Smart routing for Solana token swaps | Mainnet live |

| MarginFi | Lending | Unified lending & borrowing across Solana protocols | Mainnet live |

| Clockwork | Automation | Cron-like tasks & transaction scheduling | Acquired by Solana Foundation |

📚 Crux from Developer Reports

🧠 Electric Capital Developer Report 2025

“Solana has seen a 53% year-on-year growth in full-time developers, outperforming Ethereum in retention and developer satisfaction for low-latency applications.”

📘 Solana Foundation 2025 Ecosystem Grant Report

“Over $15 million in grants were disbursed in the first half of 2025, leading to the launch of 300+ new dApps and tooling libraries.”

🔬 Why Developers Prefer Solana

- High TPS (Transactions Per Second): Real-world throughput above 65,000 TPS.

- Low fees: < $0.001 average per transaction.

- Growing standards: Anchor Framework simplifies program development like Hardhat does for Ethereum.

“Solana’s fast block finality and scalable parallel runtime let me do things I can’t imagine on Ethereum today.”

— Lucas Watkins, Developer of Drift Protocol

“The network feels like Web2 with Web3 benefits. It’s what builders were waiting for.”

— Jessica Ma, co-founder of PsyFi

Solana Hacker House & Dev Portal – solana.com:

Solana’s global “Hacker Houses” initiative has trained 10,000+ developers in 2024–2025. Online toolkits like Playground and Solana Cookbook accelerate time-to-build and enable rapid prototyping.

Electric Capital Developer Report 2025:

Solana has more new contributors in 2025 than any other L1, driven by “a real sense of velocity, better documentation, and strong community support.”

Part 12: Cross-Chain Compatibility and Future Interoperability

🌉 The New Multichain Reality

In 2025, blockchain is no longer a siloed ecosystem. Users, dApps, and assets are moving freely across chains. Interoperability has become a key metric for evaluating long-term viability — and Solana is stepping up aggressively.

While Ethereum started the movement with bridges and rollups, Solana is now carving its niche by embracing seamless Layer 1-to-Layer 1 connectivity, native asset swaps, and integration with emerging protocols like Wormhole, LayerZero, and Hyperlane.

🔗 Interoperability Key Points

- Wormhole Protocol enables Solana assets to move across 20+ chains including Ethereum, BNB, Polygon, and Cosmos.

- Solana has supported native USDC issuance across multiple chains via Circle’s Cross-Chain Transfer Protocol (CCTP).

- Projects like Tensor, Drift, and Jupiter allow cross-chain DeFi with minimal latency.

- LayerZero partnership (2025) enables secure messaging and asset bridging to Ethereum, Arbitrum, and more.

🔁 Top Interoperability Projects on Solana (2025)

| Project | Interoperability Role | Supported Chains | Status |

|---|---|---|---|

| Wormhole | General-purpose bridge | Ethereum, BNB, Cosmos, Avalanche, etc. | Mainnet Active |

| LayerZero | Omnichain messaging & bridging | Arbitrum, Ethereum, Aptos, Solana | Live Integration in Q2 2025 |

| Circle CCTP | USDC cross-chain transfers | Ethereum, Avalanche, Solana | Fully Deployed |

| Jupiter DEX Aggregator | Cross-chain token swaps | Solana + bridged tokens (via Wormhole) | Available via Wormhole Routes |

📚 Crux from Developer & Interop Reports

🧠 Circle’s Q1 2025 CCTP Report:

“Solana leads in native USDC adoption and usage among L1s thanks to ultra-low fees and integration speed. Cross-chain transfers complete in under 30 seconds.”

🔎 Wormhole Ecosystem Report:

“Over $8 billion in bridged assets have flowed through Wormhole to and from Solana in the first half of 2025, with gaming and DeFi being the top use cases.”

🔍 Deep Dive: Solana vs Ethereum on Interoperability

| Feature | Solana | Ethereum |

|---|---|---|

| Native USDC Support | Yes (Circle-issued) | Yes (also Circle-issued) |

| Bridging Infrastructure | Wormhole, LayerZero, CCTP | Polygon Bridge, Arbitrum, Optimism |

| Bridge Finality Time | ~20–30 seconds | 2–5 minutes (average) |

| Cost of Bridging | < $0.01 | $5–$20 (gas-intensive) |

| Supported Chains | 20+ via Wormhole | Mostly L2s and major L1s via custom bridges |

📦 Cross-Chain Benefits for Solana Users

- Speed: Near-instant transfers across chains.

- Cost Efficiency: Massively cheaper than Ethereum bridges.

- DeFi Liquidity: Access liquidity from multiple ecosystems through aggregators.

- NFT Movement: Solana NFTs now trade across Ethereum and Polygon marketplaces.

Part 13: Solana’s Real-World Enterprise Adoption

From NFTs to Big Tech: How Solana Is Gaining Ground

🌍 Enterprise Use Cases Expanding Solana’s Credibility

Solana’s reputation as a high-performance Layer 1 blockchain has steadily moved beyond retail DeFi and NFT use. In 2025, it is becoming a strong candidate for real-world enterprise integration. Here are some key industries and corporations either experimenting with or actively deploying Solana-based solutions:

✅ Solana Enterprise Adoption Use Cases (2025)

| Industry | Enterprise | Application on Solana | Impact/Status (2025) |

|---|---|---|---|

| Social Media | Telegram x TON x Solana Bridge | Cross-chain NFT and token payments | Live beta with 1M+ active users integrated |

| Finance | Stripe | On-ramp and off-ramp for USDC on Solana | Fully deployed in 40+ countries |

| eCommerce | Shopify merchants (via Solana Pay) | Payment integration for faster checkout | Over 3000+ stores adopted it globally |

| Gaming | Star Atlas | Metaverse + NFT economy built on Solana | Mainnet experience launched; over 500k players |

| Telecom | Helium Network (now on Solana) | Incentivized decentralized 5G and LoRaWAN | Expanded to 3 continents using Solana tokens |

🔎 Crux from Sources:

- Stripe’s USDC Rollout on Solana: As per their press release, Stripe integrated Solana for faster and low-cost stablecoin transactions, particularly in Latin America and Southeast Asia. Stripe noted: “Solana enables us to provide merchants with near-zero cost settlement while offering finality in seconds.”

- Helium Migration to Solana: Helium officially migrated its entire infrastructure to Solana to leverage faster block finality and scalability. The Helium Foundation said: “Solana offers Helium an unparalleled throughput layer that supports the future of decentralized wireless.”

- Solana Pay on Shopify: In a February 2025 blog, Shopify highlighted the use of Solana Pay for crypto-native checkout flows, with the lowest transaction cost among all crypto payment plugins.

- Star Atlas on Solana: The developers of Star Atlas emphasized that only Solana could handle the real-time microtransactions needed in metaverse gaming economies.

📢 Expert Opinion

“Solana’s traction with Web2 giants shows that it is no longer just a playground for crypto devs but a serious enterprise-grade infrastructure,” — Meltem Demirors, CSO at CoinShares.

Part 14: Developer Ecosystem and Community Growth

Why Builders Are Choosing Solana Over Ethereum in 2025

👨💻 Developer Activity: The Fuel Behind Solana’s Rise

A thriving blockchain needs more than users — it needs developers. In 2025, Solana’s developer ecosystem is seeing explosive growth, largely because of its:

- Fast and cheap transactions (ideal for dev iteration)

- Simplified Rust & C-based SDKs

- Robust funding from Solana Foundation and partners

- Growing open-source libraries and dApps

Let’s look at the key data:

✅ Solana vs Ethereum Developer Metrics (2025)

| Metric | Solana | Ethereum | Commentary |

|---|---|---|---|

| Monthly Active Developers | 25,000+ | 29,000+ | Ethereum leads but gap has narrowed by 40% |

| New Developers (YTD) | 12,000+ | 9,000+ | Solana has higher new dev acquisition rate |

| Hackathons (2024–25) | 28 global events | 16 global events | Solana aggressively expanding dev support |

| GitHub Commits (monthly avg) | 5,100+ | 6,000+ | Ethereum remains more mature in protocol-level commits |

| Foundation Grants Issued (USD) | $67M+ | $54M+ | Solana Foundation investing aggressively |

🔍 Crux from Verified Sources:

- Electric Capital Developer Report (2025) notes: “Solana saw a 62% year-over-year growth in developer onboarding, the highest among major chains.”

- Solana Hackathons (e.g., Hyperdrive, Grizzlython) saw record-breaking 8000+ dev submissions, most of them first-time crypto developers.

- Solana Foundation Developer Fund increased to $100 million for 2024–2025 to foster dApps, tooling, and mobile-first apps.

- Ethereum Foundation, while more conservative, is focusing on protocol R&D and zero-knowledge tech, investing in fewer but deeper grants.

🌍 Community Strength: Local and Global

Solana’s presence has become strong in developer and crypto communities through:

- Solana Hacker Houses in 20+ countries

- Discord channels with 350k+ developers

- Localized Dev Resources (India, Vietnam, Nigeria, Brazil)

- Meetups surpassing Ethereum in LATAM & SEA

✅ Solana vs Ethereum Community Expansion (2025)

| Region | Solana Dev Events (2025) | Ethereum Dev Events (2025) | Community Penetration |

|---|---|---|---|

| India | 17 | 9 | Solana leads in Tier 2/3 cities |

| Nigeria | 8 | 4 | Solana supports grassroots developer bootcamps |

| Brazil | 10 | 6 | Solana partners with local universities |

| Vietnam | 14 | 7 | Solana dominates with mobile-focused projects |

| USA | 28 | 30 | Ethereum retains slight edge in core developer meetups |

🧠 Expert Perspective

“In 2025, the real battle isn’t just TPS — it’s developer mindshare. Solana is winning the hearts of young devs and mobile builders.”

— Laura Shin, Crypto Journalist & Host of Unchained

Part 15: Security, Audits, and Resilience Track Record (2020–2025)

Why Solana’s Security Evolution is Gaining Institutional Trust

🔐 Security: From Criticism to Confidence

Solana’s early years were marred by network outages and skepticism around validator centralization. However, from 2023 onward, significant improvements in both protocol stability and security practices have emerged:

- No major network outages since early 2023

- Adoption of secure memory-safe Rust language

- Multiple third-party audits (by firms like Kudelski Security, Trail of Bits)

- Solana’s Firedancer validator client, built by Jump Crypto, enhances security through independent client architecture

✅ Security Comparison of Solana vs Ethereum (2020–2025)

| Security Factor | Solana | Ethereum | Analysis |

|---|---|---|---|

| Language Safety | Rust (memory safe) | Solidity (prone to bugs) | Solana offers a safer default for developers |

| Client Diversity | 2 (Solana Labs, Firedancer) | 5+ (Geth, Besu, Nethermind, etc.) | Ethereum remains superior in client redundancy |

| Audit Transparency | Quarterly reports since 2023 | Extensive history of open-source audits | Ethereum more mature, but Solana catching up fast |

| Downtime Incidents (2020–2025) | 5 total, none after Q1 2023 | 0 major chain halts | Solana improved, but still recovering reputation |

| Bug Bounty Size | $1 million+ | $2 million+ | Both encourage ethical hacking |

📝 Crux from Verified Reports

- Cambridge Blockchain Resilience Index (2025 Update) notes: “Solana’s stability score improved from C+ in 2022 to A- in 2025 due to client diversification and improved validator uptime.”

- Firedancer, Solana’s parallel validator client, reduces:

- Risk of monolithic software failure

- Validator bottlenecks

- Increases TPS > 1 million in testnet, showing scaling + redundancy

- Solana Foundation Bug Bounty Program:

- Paid out over $7M in security disclosures since 2023

- Encouraged white-hat activity and enhanced transparency

🔄 Key Infrastructure Upgrades

| Upgrade | Impact | Year |

|---|---|---|

| Firedancer Validator | Independent, high-performance client | 2024 (beta), 2025 (mainnet) |

| QUIC Protocol Integration | Enhances communication security | 2023 |

| Agni Validator Metrics | Improves validator health diagnostics | 2025 |

| Proof of History v2 | Further optimized for precision timing | 2025 |

✅ Timeline of Solana’s Security Evolution

| Year | Upgrade | Security Impact |

|---|---|---|

| 2022 | Transition to QUIC Protocol | Reduced congestion exploits, better DDoS resistance |

| 2023 | No major outages reported | Boosted institutional trust and uptime metrics |

| 2024 | Firedancer Client Beta | Introduced multiclient architecture for decentralization |

| 2025 | Agni Validator & PoH v2 | Enhanced resilience and real-time consensus health |

🔍 Expert Perspective

“Solana is no longer the unreliable chain of 2021. With Firedancer and consistent audits, it’s fast becoming a serious institutional-grade infrastructure.”

— Chris Blec, Blockchain Security Analyst

✅ Part 16: Tokenomics, Inflation, and Staking Yield Comparison (Solana vs Ethereum)

In this part, we compare Solana and Ethereum based on tokenomics, inflation rates, staking yields, and economic incentives — critical factors for long-term investor confidence and blockchain sustainability.

💸 Tokenomics & Monetary Policy

Both Solana and Ethereum have different economic models that impact supply, staking, and long-term sustainability.

🔍 Overview of Tokenomics (2025)

| Aspect | Ethereum (ETH) | Solana (SOL) |

|---|---|---|

| Token Supply | No hard cap (~120M ETH), deflationary post-merge via EIP-1559 | Fixed initial supply (~508M), inflationary with decaying emission rate |

| Inflation Rate (2025) | Approx. 0.5% to -1.0% (deflationary) | Approx. 4.5%, decreasing annually by 15% |

| Annual Yield (Staking) | 3.5% – 4.5% | 7.5% – 8.5% |

| Validator Requirement | 32 ETH (~$110,000+) | 1 SOL minimum (~$160+), more scalable |

| Monetary Policy Control | Community driven (EIPs, core devs) | Predetermined decaying inflation schedule |

📉 Inflation Trends (2018–2025 Crux)

Recent data from Messari, Ultrasound.money, and Solana Compass shows:

- Ethereum has become deflationary since The Merge (Sep 2022). Over 4 million ETH has been burned since EIP-1559 (as of Q1 2025).

- Solana follows a structured inflation model starting at 8% annually (2020), decaying 15% yearly. By 2025, inflation is ~4.5%.

📊 Ethereum vs Solana: Inflation Curve (2018–2025)

| Year | Ethereum Inflation Rate | Solana Inflation Rate |

|---|---|---|

| 2018 | ~7.4% | N/A |

| 2020 | ~4.6% | ~8.0% |

| 2022 (Post-Merge) | ~1.0% → Negative (due to ETH burn) | ~5.8% |

| 2023 | ~0.5% to -0.8% | ~5.0% |

| 2025 | -0.7% (deflationary) | ~4.5% |

🧠 Expert Opinions

“Solana’s high staking yield and structured inflation give it an edge for yield-focused investors, but Ethereum’s deflationary pressure supports long-term scarcity.”

— Jameson Lopp, Bitcoin Security Expert

“Solana might be inflationary, but its token velocity and burning mechanisms during high usage balance that out effectively.”

— Delphi Digital 2025 Q1 Report

🌍 Crux from Verified Sources:

- Ultrasound.money: Tracks Ethereum’s burn and inflation → Ethereum is currently deflationary at -0.7% annualized rate due to EIP-1559 and high gas usage.

- Solana Compass: Real-time staking APY and validator insights → Shows SOL staking APR between 7.8% and 8.5% depending on validator.

✅ Part 17: Ecosystem Support & Developer Growth — Solana vs Ethereum

The strength of a blockchain lies not only in its technology but in its developer activity, tooling ecosystem, community adoption, and grant support. In this section, we compare Solana and Ethereum’s ecosystem robustness and growth trajectory heading into 2025.

🔧 Developer Activity & Tooling Support

Both Solana and Ethereum have active developer ecosystems, but with different focuses:

| Aspect | Ethereum | Solana |

|---|---|---|

| Active Monthly Developers (2025) | ~5,700+ | ~2,300+ |

| Languages Used | Solidity, Vyper, Yul | Rust, C, C++, Python (via Anchor) |

| Development Frameworks | Truffle, Hardhat, Foundry | Anchor, Seahorse, Solana-CLI |

| Onboarding Ease | High (many tutorials, EVM familiarity) | Medium (Rust barrier, improving tooling) |

| Available SDKs | Many (web3.js, ethers.js, Infura, Alchemy) | Rapidly growing (Solana.js, Helius SDKs) |

📈 Developer Growth Rate (Crux from Electric Capital Report 2024)

Electric Capital’s annual developer report (2024) shows:

- Ethereum has the most developers in Web3 but saw a 6% YoY decline in part-time contributors.

- Solana saw a +31% YoY growth in full-time developers, highest across non-EVM chains.

- Post-FTX recovery, Solana regained trust via Hacker Houses, grants, and VC-backed accelerator programs.

🏗️ Ecosystem Funding & Grants

| Support Type | Ethereum | Solana |

|---|---|---|

| Grants Programs | Ethereum Foundation Grants, Arbitrum DAO, Optimism RPGF | Solana Foundation Grants, xJump DAO Grants |

| Hackathons (2024–2025) | ETHGlobal (30+ events), Devcon, local chains | Solana Hacker Houses (40+), Solana Breakpoint |

| VC Involvement | a16z, Paradigm, Coinbase Ventures | Multicoin Capital, Solana Ventures, Jump Crypto |

| DAO Developer Bounties | Yes (Arbitrum, Optimism) | Yes (Jito DAO, Helium DAO) |

🧠 Developer Sentiment (2025 Surveys)

“Solana has become a developer darling again. Rust is hard, but the reward for speed and composability is worth it.”

— 2025 HackerRank Dev Survey

“Ethereum remains the backbone of DeFi, but developers are slowly diversifying into Solana and L2s to optimize performance.”

— Bankless Developer Report 2025

🔗 External Sources (Crux Summary)

- Electric Capital Developer Report 2024:

- Ethereum: ~5,700 monthly active devs

- Solana: ~2,300, with highest YoY growth (+31%)

- Growth attributed to Solana’s Hackathons and Rust education initiatives.

- Solana Foundation Blog (2025):

- Over $50M allocated in developer grants in past 18 months.

- Anchor Framework v2.0 launch simplified Rust development by 40%.

- Ethereum Foundation Grants Page:

- Focused on ZK-rollups, protocol dev, L2s, and security audits.

- Ongoing support for Ethereum core client teams (Geth, Besu, Nethermind).

✅ Part 18: Institutional Partnerships & Real-World Use Cases — Solana vs Ethereum

As we approach 2025, both Ethereum and Solana have significantly expanded their real-world integrations, thanks to growing institutional confidence and clearer regulations. This section outlines the adoption trajectories, strategic partnerships, and real-world applications that elevate each chain beyond speculative use.

🏦 Institutional Adoption: Solana vs Ethereum

| Category | Ethereum | Solana |

|---|---|---|

| CBDC Pilots | European Investment Bank, Banque de France (pilot on Ethereum) | None officially announced |

| Enterprise Integration | EY OpsChain, JPMorgan Onyx (Quorum), Baseline Protocol | Visa for USDC settlement on Solana; Shopify for payments via Solana Pay |

| Payment Partnerships | Circle, PayPal (USDC, PYUSD on Ethereum) | Visa (USDC settlement), Worldpay, Phantom Pay |

| NFT Utility Expansion | Polygon + Starbucks, Reddit Avatars (via Ethereum L2s) | Solana NFTs used in games (Star Atlas, Genopets), Phantom Wallet native support |

| Gaming | Immutable X (L2), Gala Games | Solana Mobile Stack, Helium Hotspot Gaming, xNFT integrations |

🏛️ Key Real-World Use Cases (with Source Crux)

✅ 1. Visa x Solana (USDC Settlement)

- Visa announced in Sep 2023 that it would settle USDC transactions on Solana.

- This significantly reduced settlement latency from days to seconds.

- Visa cited Solana’s high TPS (~65,000) and low fees (~$0.00025 per txn) as key advantages.

- Crux from Visa Newsroom: “Solana offered the throughput and speed for real-time settlement of cross-border payments.”

✅ 2. Shopify + Solana Pay Integration (July 2023)

- Shopify added Solana Pay as a checkout option.

- Enables merchants to accept stablecoins like USDC directly on-chain.

- Solana Pay offers instant finality and zero intermediary fees.

✅ 3. Ethereum CBDC and Banking Use

- European Investment Bank issued €100M digital bonds on Ethereum (2021 & 2023).

- Banque de France used Ethereum in CBDC experiments for cross-border remittances.

- JPMorgan’s Onyx Network runs permissioned Ethereum for institutional DeFi.

🧠 Summary Analysis Table

| Blockchain | Institutions Actively Using | Focus Areas | 2025 Outlook |

|---|---|---|---|

| Ethereum | JPMorgan, EY, PayPal, EIB | CBDC, bond issuance, L2 payments, compliance | Remain dominant for regulated DeFi and banking |

| Solana | Visa, Shopify, Phantom, Worldpay | Instant settlement, retail payments, NFTs, gaming | Strong growth in payments and consumer-facing apps |

🔗 External Source Crux Summary

- Visa USDC Announcement (Sep 2023) “Visa now settles USDC on Solana to support real-time payment infrastructure. Lower costs and instant throughput were the deciding factors.”

– Visa Official Blog - Shopify Blog (2023) “Merchants on Shopify can now accept USDC through Solana Pay—an open, instant, and decentralized payment rail.”

- European Investment Bank “Ethereum’s transparency and security make it ideal for issuing digital bonds and programmable money.”

✅ Part 19: Community Culture & Web3 Ethos — Solana vs Ethereum

One of the most critical—and often overlooked—factors when choosing a blockchain platform is its community ethos, cultural direction, and alignment with the Web3 vision. In this section, we evaluate how Ethereum and Solana differ in philosophy, decentralization values, innovation style, and community behavior, which strongly influence long-term developer engagement and user trust.

🧬 Community Culture Comparison

| Aspect | Ethereum | Solana |

|---|---|---|

| Core Philosophy | “Decentralize everything”, heavy focus on self-sovereignty, censorship resistance | “Speed, scale, usability” with performance-driven decentralization |

| Founding Ethos | Vitalik Buterin’s vision of open-source programmable money | Anatoly Yakovenko’s background in telecom led to a focus on hardware-level optimization |

| Community Governance | Robust proposal system (EIP), active on-chain DAO tooling | Early-stage DAO ecosystem, governance growing via Realms and SPL tools |

| Event Culture | Devcon, ETHGlobal, HackMoney – hackathon-first, grassroots | Breakpoint, Solana Hacker Houses – performance and product-centric |

| Influencer Presence | Vitalik, Bankless, ETH Research contributors | Raj Gokal, Solana Labs, Austin Federa, Jump Crypto |

🌐 Web3 Alignment: Decentralization vs Performance

| Criteria | Ethereum | Solana |

|---|---|---|

| Node Count | 10,000+ (Globally distributed) | ~3,000 (Higher hardware requirements) |

| Decentralization Philosophy | Maximum decentralization, low entry | Optimized for performance over pure decentralization |

| Validator Hardware Needs | Low-to-Medium | High (CPU/GPU intensive) |

| Block Propagation Speed | 12 seconds (Post-Merge) | 400 milliseconds |

| Throughput vs Trustlessness | Trustless & slower | Faster but more centralized risk |

🔍 Crux from Key Community Sources

- Vitalik Buterin’s 2023 blog on decentralization: “Ethereum’s long-term resilience depends on its ability to empower individuals and communities to participate in core infrastructure decisions, not just financial returns.”

- Solana Foundation’s community blog 2024: “We believe Web3 needs to be fast, fun, and frictionless. Solana’s mission is to enable global-scale dApps for 1 billion people—not just coders.”

- ETHGlobal Hackathons Report:

- Over 5,000+ developers across 40+ countries participate annually.

- Hackathons focus on ZK, modularity, Layer 2 innovation.

- Breakpoint 2023 Stats:

- Featured Solana Mobile, Firedancer, NFT gaming, and DePIN (Helium) integrations.

- 3x increase in Solana developer signups post-event.

🧭 Web3 Culture & Alignment

| Dimension | Ethereum | Solana |

|---|---|---|

| Developer Community | Larger, ideologically driven | Growing, product-first mindset |

| Governance Approach | Democratic, decentralized via DAOs | Foundation-centric, evolving DAOs |

| Community Events | Hackathons, zkSummits, Devcon | Breakpoint, Hacker Houses |

| Ideological Leaning | Libertarian-crypto-native | Pragmatic, performance-focused |

| Web3 Alignment Score (2025) | 9.5 / 10 | 8 / 10 |

✅ Part 20: Long-Term Developer Retention & Ecosystem Vitality — Solana vs Ethereum

One of the best indicators of a blockchain’s long-term viability is how well it retains and grows its developer base. A vibrant developer ecosystem drives continuous innovation, protocol upgrades, app development, and community trust. This section compares Solana and Ethereum in terms of long-term developer retention, available tooling, funding, and overall ecosystem momentum.

👨💻 Active Developer Comparison

| Metric | Ethereum | Solana |

|---|---|---|

| Monthly Active Developers (2024) | 5,769 | 925 |

| Monthly Core Protocol Developers | 420+ | 110+ |

| Tooling Maturity | Very High (Hardhat, Foundry, Ethers.js) | Medium (Anchor, Solana CLI, Seahorse) |

| Learning Curve | Moderate to High | High (Rust is challenging) |

| Documentation Depth | Extensive (OpenZeppelin, EIPs) | Improving (Solana Docs, Anchor Book) |

Source: Electric Capital Developer Report 2024

💡 Crux of Electric Capital Report (2024):

- Ethereum retains over 30% of all Web3 developers long-term.

- Solana grew its full-time dev count by 33% YoY in 2024.

- Solidity remains the top choice, but Rust devs on Solana earn 40% more on average due to demand.

🚀 Ecosystem Momentum & Funding

| Funding Source | Ethereum | Solana |

|---|---|---|

| Protocol Foundation Grants | Ethereum Foundation, EF Ecosystem Support Program | Solana Foundation, Jump Crypto, Solana Labs |

| Startup Funding Ecosystem | Consensys, a16z Crypto, Paradigm | Multicoin Capital, Solana Ventures, Lightspeed |

| Accelerators & Hackathons | ETHGlobal, Gitcoin, Devfolio | Solana Hacker House, Breakpoint Hackathons |

| Developer Retention (Avg. > 1 year) | 65% | 48% |

🧠 Tooling & Language Support

| Tooling Aspect | Ethereum | Solana |

|---|---|---|

| Primary Language | Solidity, Vyper | Rust, C, Python (via Seahorse) |

| Popular Frameworks | Hardhat, Truffle, Foundry | Anchor, Seahorse, Solana CLI |

| Smart Contract Verification | Etherscan + Sourcify | Solana Explorer + External Tools |

| Simulators & Debuggers | Foundry (Forge), Remix IDE | Solana Playground, Anchor Debugger |

| On-chain Interop Tools | Ethers.js, Web3.js, Wagmi | Solana.js, Web3.js (Solana fork) |

🎯 Developer Focus Summary

| Category | Ethereum | Solana |

|---|---|---|

| Long-term Developer Retention | Excellent (Strong EIP & Gitcoin system) | Improving, still maturing |

| Dev Earnings Potential | Medium-High | High (Rust premium) |

| Onboarding Tools | Well-documented, community-driven | Rapidly expanding (Anchor Book, Solana U) |

| Developer Satisfaction (2025 Projections) | 9.2 / 10 | 8.4 / 10 |

✅ Part 21: Final Verdict – Why Solana May Outshine Ethereum in 2025

As we step into 2025, Solana’s rapid evolution in performance, user experience, and ecosystem tooling positions it as a formidable contender — not just to coexist with Ethereum, but to potentially lead in consumer-grade Web3 adoption.

While Ethereum continues to dominate institutional-grade DeFi and retains unmatched decentralization, Solana’s laser-focus on speed, scalability, and mobile-first experiences makes it the top choice for:

- Retail Apps & NFTs: Ultra-low fees and real-time responsiveness are ideal for gaming, ticketing, and microtransactions.

- Developers: With frameworks like Anchor and Rust’s performance efficiency, dev onboarding is accelerating.

- Global Expansion: Solana’s mobile initiatives (like the Saga phone) and local validator incentives appeal to underserved markets.

🧮 Comparative Summary Table

| Factor | Ethereum | Solana |

|---|---|---|

| Transaction Speed | ~12 seconds (post-Merge) | ~400 milliseconds |

| Scalability | Rollups-dependent (modular) | Monolithic scaling, up to 65K TPS |

| Fees | Often >$1 | Fraction of a cent |

| App Focus | Finance, DAOs, NFTs | Mobile apps, Gaming, Global adoption |

| Developer Trend | Stable with high retention | Fast-growing, Rust-friendly |

📌 Conclusion:

Solana’s performance-driven ecosystem does not try to beat Ethereum at its own game. Instead, it opens new doors—delivering crypto to the next billion users who expect apps that are fast, seamless, and mobile-native.

📢 For builders targeting Web3 mass adoption in 2025, Solana may be the blockchain of choice.